Highlights:

- The European Union passed a new Anti-Money Laundering law prohibiting crypto service providers from facilitating anonymous crypto payments of over 3,000 euros.

- Thailand’s SEC approves institutional investors and ultra-high-net-worth individuals to invest in private USA-based spot Bitcoin ETFs.

- From 2025, Indonesian financial services authorities (OJK) will take over the regulation of the crypto industry. Under OJK regulation, a regulatory screening program will evaluate all new crypto products and services before they can start operating legally.

Forecast

Regulators will push to increase transparency and reporting within the DeFi sector, purportedly to reduce fraud and scams. Uniswap Labs will likely have to turn over customer information in response to the Wells notice, which would undermine users’ privacy in decentralized finance.

Sentiment

The SEC’s recent action against Uniswap Labs underscores the need for Congress to craft tailored legislation for cryptocurrencies. Without clear regulations, crypto companies may struggle to operate lawfully within the U.S. and be subject to SEC attacks due to regulatory ambiguity.

Analysis

The U.S. Securities and Exchange Commission (SEC) has issued a Wells notice to Uniswap Labs, the development company behind Ethereum’s leading decentralized exchange (DEX). A Wells notice is a formal letter issued by the SEC following an internal investigation to inform the recipient that the agency intends to bring legal action against them. The market initially reacted negatively to the news, with the Uniswap Total Locked Value dropping from a local high of $7.07B to $5.01B. The value of the Uniswap token also declined to a two-month low. This marks the first time that the SEC has targeted a DEX.

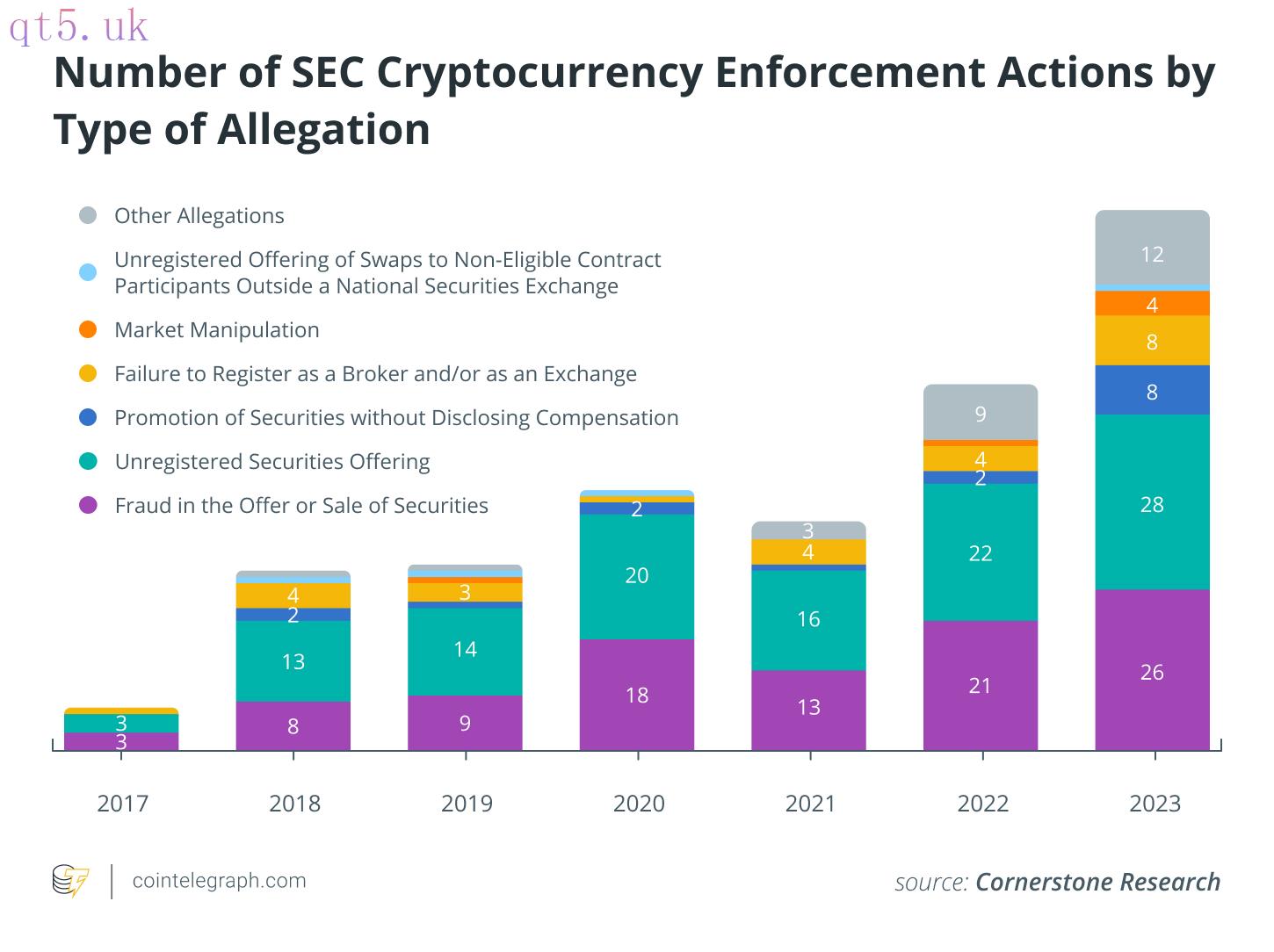

Over the past seven years, the SEC has increasingly targeted crypto companies as it tries to apply existing securities laws to digital currencies. Last year, 61% of the SEC’s 46 enforcement actions against crypto companies were for offering unregistered securities. The regulatory action against Uniswap Labs is the fifth such filing this year. Uniswap Lab’s chief operating officer, Mary-Catherine Lader, and chief legal officer, Marvin Ammori, confirmed in a press conference that the Wells notice alleges Uniswap Labs acted as an unregistered securities broker and is an unregistered securities exchange.

For a transaction to qualify as an investment contract, i.e. a security, in the U.S., it must meet the four criteria of the Howey test. The test requires an investment of money into a common enterprise with an expectation of profits from the efforts of others. Uniswap Labs has attempted to clarify that they merely developed the user interface and smart contracts for their platform and stated that the underlying protocol is open-source and decentralized. Therefore, they argue, Uniswap Labs is not a securities exchange because they do not themselves issue and list securities. Further, Uniswap Labs states that most transactions on their platform involve stablecoins, community tokens, and commodities, none of which are securities in their view. Uniswap Labs has until the 9th of May 2024 to respond to the SEC’s allegations.

download

download download

download website

website