Traders have been eagerly waiting for Bitcoin (BTC) to break out of its range, but that has not yet happened. The longer the price remains inside the range, the greater the force needed for the breakout. A bullish sign is that the spot Bitcoin exchange-traded funds have witnessed net inflows for 19 days in a row. This shows solid buying in anticipation of the resumption of the uptrend.

Other than Bitcoin ETFs, firms are also directly investing in Bitcoin. A June 6 S-3 filing by Nasdaq-listed medical manufacturer Semler Scientific shows that it owns 828 Bitcoin, having purchased its first lot of 581 Bitcoin on May 28. The firm said it has kept its options open to raise an additional $150 million of debt securities, primarily for general corporate purposes, including Bitcoin purchases.

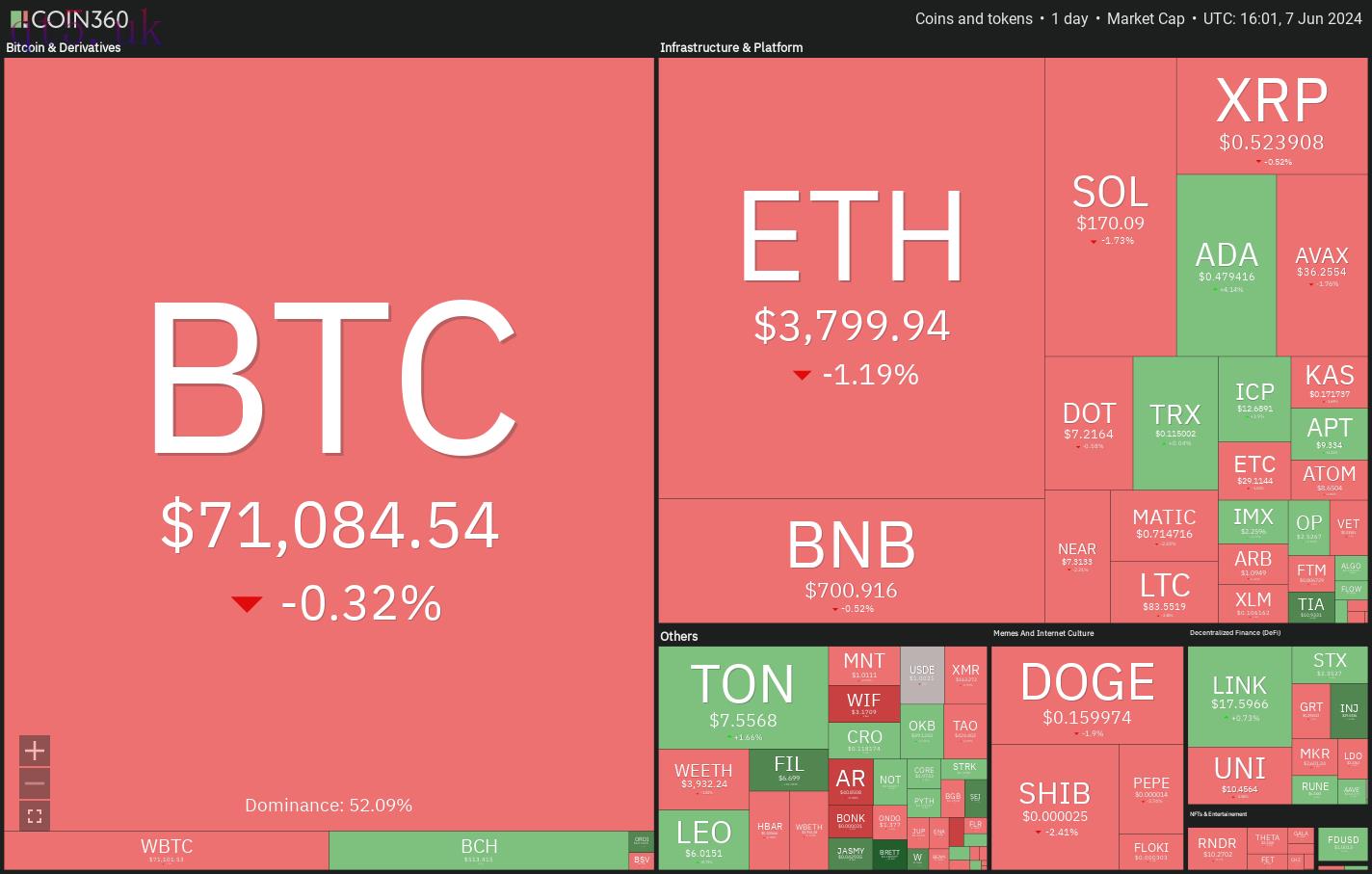

Crypto market data daily view. Source: Coin360

Crypto market data daily view. Source: Coin360In addition to the growing demand for Bitcoin ETFs, the institutions seem to be showing interest in investing in altcoins. According to a June 6 report from The Information, asset manager Franklin Templeton is considering a private fund that will expose institutional investors to altcoins.

Could buyers maintain the momentum and propel Bitcoin to a new all-time high? Will that boost buying in select altcoins? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price analysis

The bears tried to pull Bitcoin back below the psychological level of $70,000 on June 6 but the bulls held their ground. This suggests that the buyers are trying to flip the $70,000 level into support.

BTC/USDT daily chart. Source: TradingView

BTC/USDT daily chart. Source: TradingViewThe upsloping 20-day exponential moving average ($68,609) and the relative strength index (RSI) are in the positive zone, indicating that the bulls have the edge. The BTC/USDT pair could rise to the stiff overhead resistance at $73,777.

If the price turns down from $73,777, it is likely to find support at the 20-day EMA. A bounce off this level will increase the likelihood of a break above $73,777. The pair may then climb to $80,000 and later to $88,000.

On the contrary, a break below the 20-day EMA will signal that the range-bound action may extend for a few more days.

Ether price analysis

Ether (ETH) has been struggling to start a strong recovery off the $3,730 support, indicating that demand dries up at higher levels.

ETH/USDT daily chart. Source: TradingView

ETH/USDT daily chart. Source: TradingViewHowever, the upsloping 20-day EMA ($3,684) and the RSI in the positive territory suggest that the bulls are in control. If the price rises from the current level and above $3,900, the ETH/USDT pair could move to $3,977 and eventually to $4,094.

On the other hand, if the price continues lower and breaks below the 20-day EMA, it will suggest that the bulls have given up and are booking profits. That could sink the pair to the 50-day simple moving average ($3,342).

BNB price analysis

BNB (BNB) is in an uptrend, but the rally is facing resistance near $722, suggesting profit-booking from short-term traders.

BNB/USDT daily chart. Source: TradingView

BNB/USDT daily chart. Source: TradingViewThe bears will try to yank the price down to the breakout level of $635. If the BNB/USDT pair rebounds off this level with strength, it will signal that the bulls have flipped $635 into support. That will improve the prospects of a rally to the pattern target of $775.

The first sign of weakness will be a break and close below the $635 support. The selling could intensify after the bears sink the price below the uptrend line. That may start a down move to $536.

Solana price analysis

Solana (SOL) once again took support at the 20-day EMA ($167) on June 6, indicating that the bulls are viewing the dips as a buying opportunity.

SOL/USDT daily chart. Source: TradingView

SOL/USDT daily chart. Source: TradingViewBuyers will try to retain their advantage and push the price to $189. This level may act as a hurdle, but it is likely to be crossed. The SOL/USDT pair could then attempt a rally to the formidable resistance of $205.

If bears want to prevent the up move, they will have to quickly drag the price below the 50-day SMA ($156). If they do that, the pair may drop to $140 and subsequently to the critical support at $116.

XRP price analysis

XRP (XRP) continues to trade near the moving averages, indicating a lack of aggressive buying or selling by the traders.

XRP/USDT daily chart. Source: TradingView

XRP/USDT daily chart. Source: TradingViewThe flattish moving averages and the RSI near the midpoint suggest that the dull price action may continue for a while. If the price breaks and closes above $0.54, it will indicate that the bulls are trying to make a comeback. The XRP/USDT pair could rise to the overhead resistance of $0.57.

On the contrary, if the price turns down and plunges below the support line, it will negate the bullish ascending triangle pattern. The pair may fall to the $0.46 support.

Dogecoin price analysis

Dogecoin (DOGE) has been stuck between $0.18 and the 50-day SMA ($0.15) for the past few days.

DOGE/USDT daily chart. Source: TradingView

DOGE/USDT daily chart. Source: TradingViewThe flat moving averages and the RSI near the midpoint suggest that the range-bound action may continue for some more time. If the price turns up from the moving averages, the bulls will attempt to push the DOGE/USDT pair to $0.18.

On the downside, a break and close below the 50-day SMA will signal that the bulls have given up. That could start a drop to $0.14 and thereafter to the pivotal support at $0.12. The bulls are expected to defend this level with vigor.

Toncoin price analysis

Toncoin (TON) nudged above the $7.67 overhead resistance on June 7, indicating that the bulls are trying to resume the uptrend.

TON/USDT daily chart. Source: TradingView

TON/USDT daily chart. Source: TradingViewThe upsloping 20-day EMA ($6.77) and the RSI near the overbought territory suggest that the path of least resistance is to the upside. If buyers drive and maintain the price above $8, the TON/USDT pair could rally to $10.

The crucial support to watch on the downside is the 20-day EMA. A bounce off this support will suggest that the bulls are in control, but a break below it will signal that the buyers are losing their grip. The pair may then slide to the 50-day SMA ($6.25).

Related: BTC price dips 1.8% as Bitcoin tackles 'schizophenic' new US jobs data

Shiba Inu price analysis

The bulls pushed Shiba Inu (SHIB) above the moving averages on June 5 but could not build upon the strength.

SHIB/USDT daily chart. Source: TradingView

SHIB/USDT daily chart. Source: TradingViewThe bears are trying to pull the price below the moving averages and the support line. If they manage to do that, the ascending triangle pattern will be invalidated, which could start a slide to $0.000018.

Instead, if the price turns up from the current level, it will suggest that the bulls are aggressively defending the support line. The SHIB/USDT pair could rise to the overhead resistance of $0.000030.

Cardano price analysis

Cardano (ADA) has been trading inside a symmetrical triangle pattern for several days, signaling a tussle between the bulls and the bears.

ADA/USDT daily chart. Source: TradingView

ADA/USDT daily chart. Source: TradingViewAfter hesitating for a few days, traders pushed the price above the moving averages on June 7. The ADA/USDT pair could reach the triangle’s resistance line, where the bears are expected to mount a strong defense. If buyers overcome the barrier, the pair could rally to $0.62. There is a minor resistance at $0.57, but it is likely to be crossed.

Contrarily, if the price turns down sharply from the resistance line, it will indicate that the bulls are booking profits. That may keep the pair stuck inside the triangle for some more time.

Avalanche price analysis

Avalanche (AVAX) has been trading close to the moving averages for the past few days, signaling a balance between supply and demand.

AVAX/USDT daily chart. Source: TradingView

AVAX/USDT daily chart. Source: TradingViewThe flattish moving averages and the RSI near the midpoint do not give a clear advantage either to the bulls or the bears. If the price maintains above the moving averages, the AVAX/USDT pair could rally to $42.

Alternatively, if the price turns down and breaks below $34, it will suggest that the bears are trying to take charge. The pair could then slide to $29, where buyers are likely to step in. The next directional move is expected to begin above $42 or below $29.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

download

download download

download website

website