EUR/USD remains neutral ahead of US jobs data

The EUR/USD exchange rate remains neutral ahead of the release of the US employment data. On Thursday morning, after a slight rise in the previous session, the EUR/USD pair stabilized at around 1.1077, remaining in a sideways consolidation range. Investors are actively waiting to prepare for the release of key employment data, including today's ADP private sector employment report.

Although there is no direct correlation between the ADP report and Friday's non-farm payrolls (NFP) report, it provides a reference for the overall market sentiment. In addition, the market will focus on today's weekly unemployment claims data, especially considering the Fed's emphasis on employment indicators. These data may gradually increase the volatility of the EUR/USD during the day.

The market focus will also quickly turn to Friday's important employment indicators, including new non-farm payrolls, unemployment rate, and average hourly earnings in August. These indicators are crucial for the September Fed meeting. Strong employment data may support the Fed's 25 basis point rate cut, while weak labor market data may increase expectations of a 50 basis point rate cut.

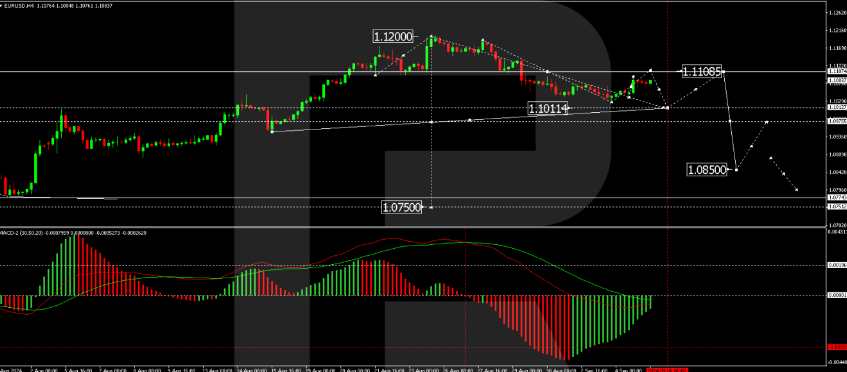

From a technical analysis point of view, the EUR/USD is currently consolidating mainly around 1.1065. Today, the 1.1107 level is expected to be tested, which is considered a corrective phase in the main downward trend. After this potential rise, the exchange rate is expected to fall further to 1.1060. Once this level is broken, the downward trend may continue and may hit 1.1016. The MACD indicator supports this bearish outlook, with its signal line below zero and pointing downwards. On the H1 chart, EUR/USD continues to adjust around 1.1065 and is expected to fall slightly to 1.1056 and then extend again to 1.1107 as part of a corrective pattern. Once this corrective phase is completed, the downward trend will resume. The Stochastic Oscillator is currently slightly above 20, which indicates that there is still short-term upward momentum, and a rise to 80 may continue the overall bearish trend.

Please note that any forecasts contained in this article are based on the author's personal opinions and should not be considered as trading advice. RoboForex does not assume any responsibility for the results of transactions based on the content of this article.

- AI-CrypTo platform provides you with the safest, most stable and most profitable cryptocurrency automatic quantitative trading system! With a minimum deposit of 10 USDT, you can activate your investment account and enjoy stable returns and flexible withdrawals! 💵

- Each model has a different rate of return, choose a higher level of investment to earn more! AI quantitative returns range from VIP1 to VIP11, with daily returns as high as 40.9%! The more you invest, the greater the return! 💸

download

download download

download website

website