Highlights:

- Venture capital investments into crypto companies are projected to reach $12 billion in 2024 according to PitchBook. This is only a 27% increase from the $9.4 billion raised last year despite Bitcoin’s new ATH.

- Aquarius, a New York-based cryptocurrency venture capital firm, has launched a multi-strategy liquidity fund with $600 million in AUM. The initiative is backed by Bitrise Capital, mining companies, family offices and influencers. The fund is designed to offer both short-term and long-term liquidity management solutions tailored to various risk scenarios.

- Securitize completed a $47 million funding round led by BlackRock, together with Hamilton Lane, ParaFi Capital and Tradeweb. The capital is aimed at the expansion of the Securitize business, targeting new tokenization markets.

Analysis

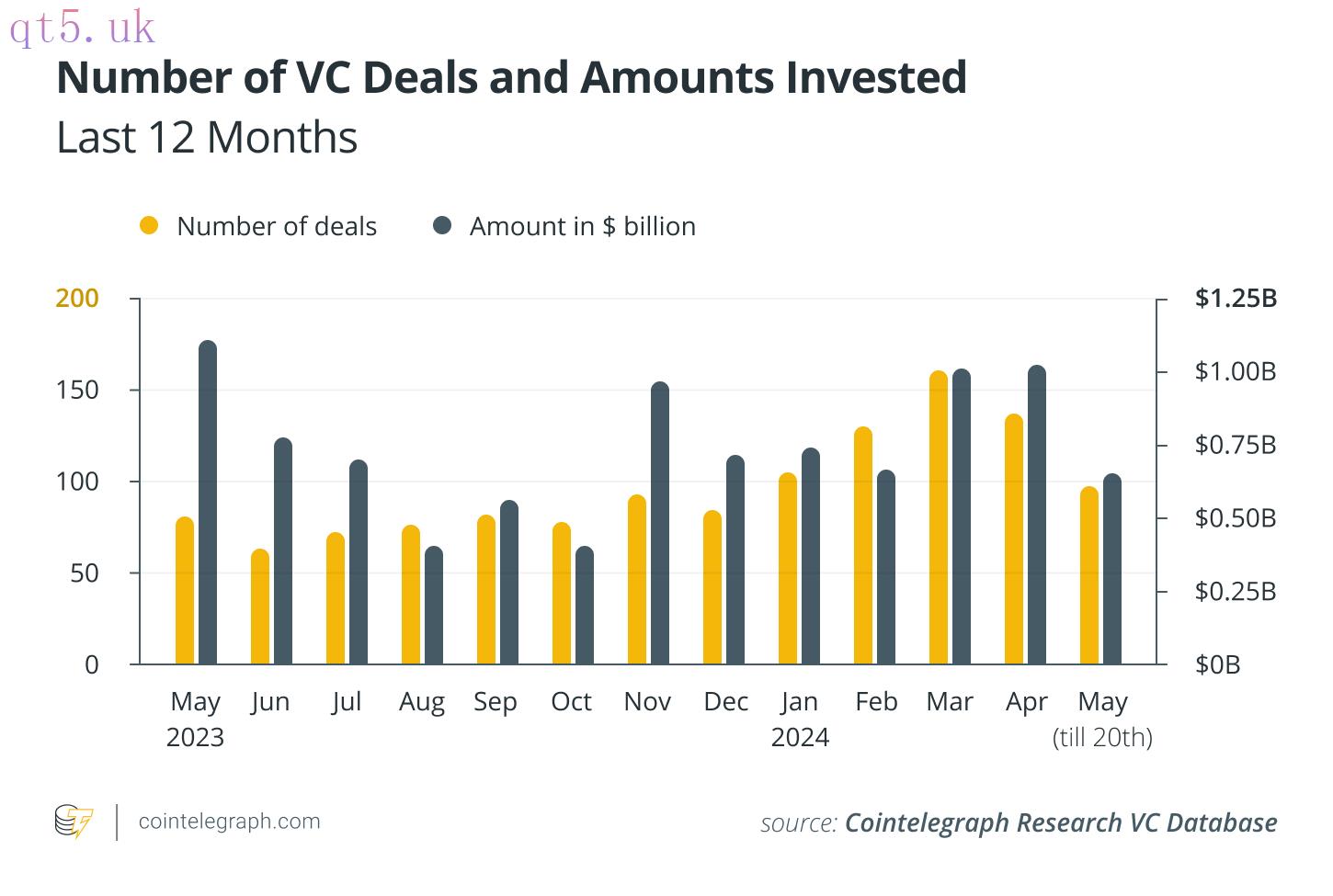

April concluded with the highest funding amount in six months. It also marked the second consecutive month in which investment figures exceeded the $1 billion mark. However, May reversed this trend, and the total investment volume remained modest. As of May 27th, the monthly total funding amounted to $650 million across 98 rounds.

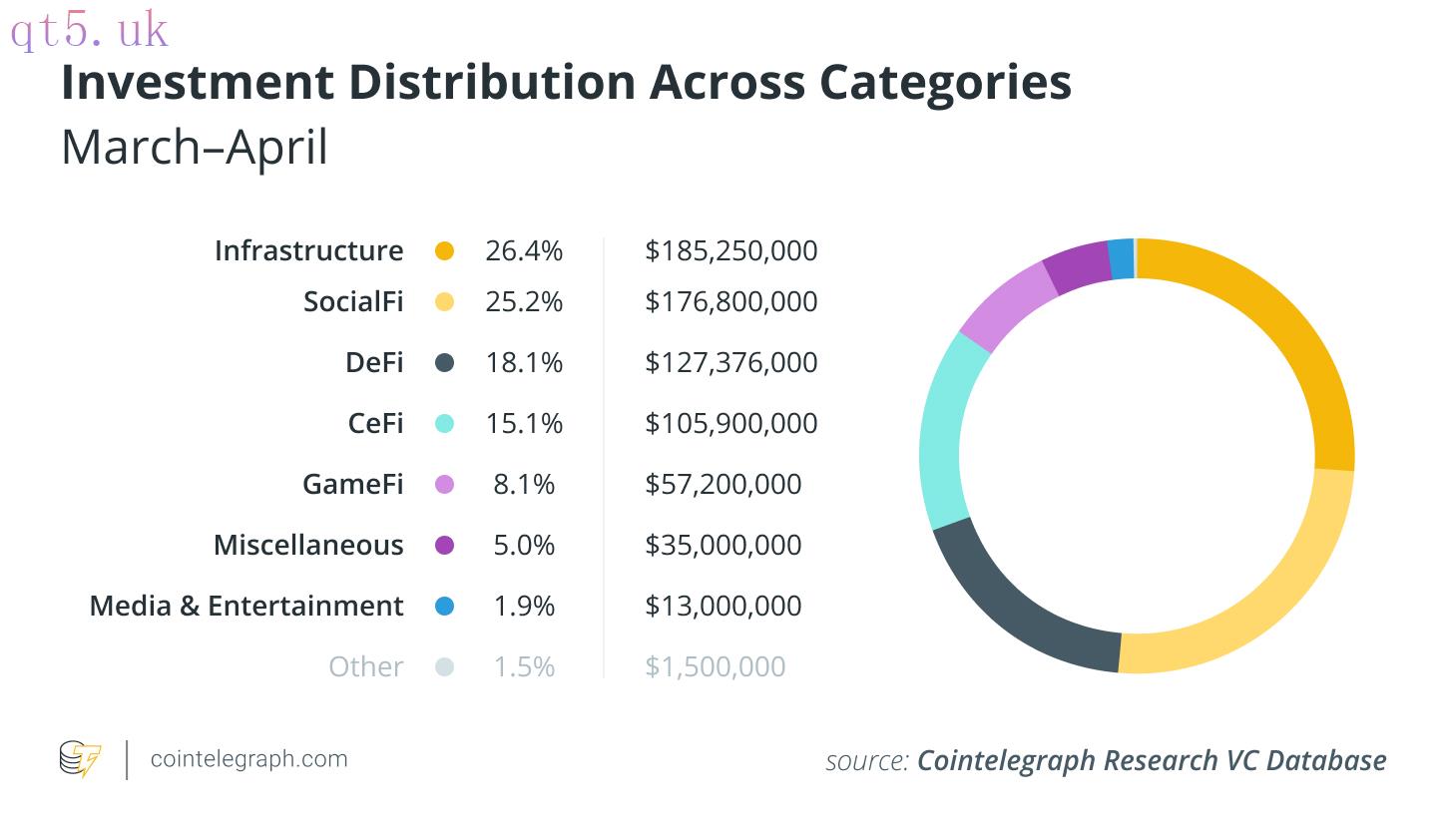

Infrastructure remained the most popular category during this period, attracting around $185 million. This was followed by SocialFi, with $176 million in investments. DeFi and CeFi, in turn, raised $127 million and $106 million, respectively. The unusually high number for SocialFi is due to a single deal, namely the $150 million Series A deal of Farcaster.

Despite the positive investment figures in Q1 2024 and the strong performance in April, several issues persist in the crypto VC landscape. After suffering losses through the crypto bankruptcy wave of 2022, major limited partners (LPs) have taken a cautious stance toward crypto VC investments. The Ontario Teachers’ Pension Plan wrote down its $95 million investment in the fraudulent crypto exchange FTX to zero in late 2022 and decided to steer clear of future crypto bets. Similarly, CDPQ, Canada’s second-largest pension fund, suffered a $150 million loss from its investment in the now-defunct cryptocurrency lending platform Celsius Network. LPs are now much more hesitant to allocate large amounts of capital to crypto VCs.

In response, crypto VC firms are increasing their focus on sound financials and business plans. This includes a focus on the Distributed to Paid-In Capital metric (DPI) of their funds rather than their nominal market value. DPI represents the amount of cash distributions that LPs receive in relation to their initial investments. In contrast to traditional venture capital firms, whose equity positions in startups are sometimes difficult to exit, crypto VCs tend to hold more liquid investments, such as tokens. Hence, in order to attract the LPs’ trust and capital, some crypto VC firms, such as Polychain, initiated the distribution of returns to investors as cash payouts. Polychain sold half the assets of its first VC fund earlier this year and 44% of its Venture II fund in May to distribute proceeds to investors. This strategy can help to attract more conservative, less crypto-native investors, such as university endowments.

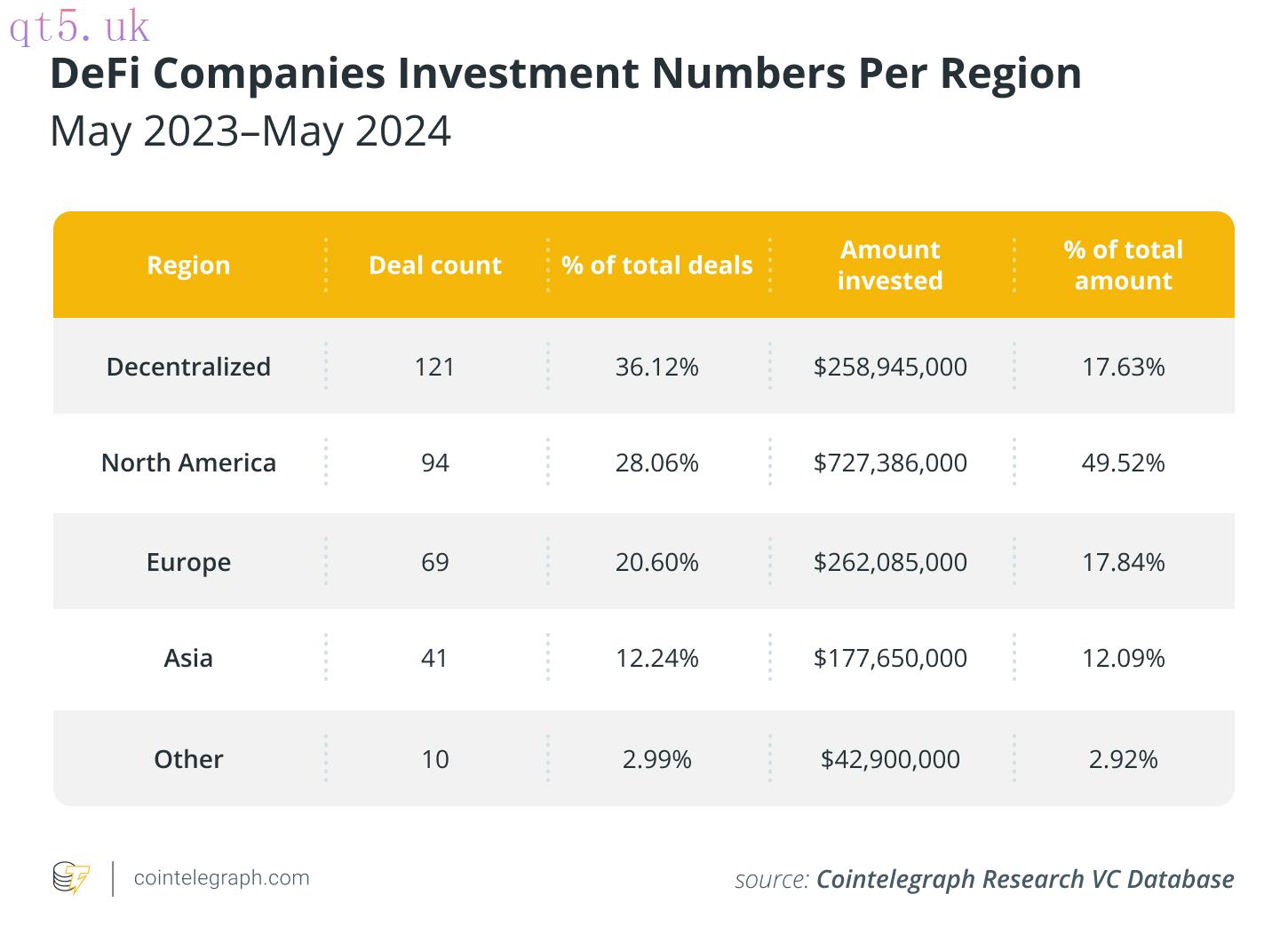

Regulatory developments further complicate conditions for high-risk VC investments. In particular, DeFi projects, which have historically made up a sizable portion of VC allocations, are facing uncertainty in one of their largest markets due to MiCa. Between May 2023 - May 2024, around 20% of DeFi VC deals involved European companies with over $260 million invested. According to the European Securities and Markets Authority (ESMA), approximately 20-25% of DeFi projects also have significant operations or user bases within the EU. MiCa regulation was recently augmented by a law that could force licensing and KYC requirements on these businesses. Such requirements would significantly suppress DeFi activity, making the sector a more risky investment proposition. The most notable investors in the EU-based companies YoY are Fabric Ventures and DWF Labs, with 4 investments each, followed by Binance Labs, Psalion VC and Framework Ventures, with 3 investments. The current regulatory provision may affect their portfolio companies’ operating costs and profitability and could result in negative changes to their balance sheets.

download

download download

download website

website