Highlights:

- Bitcoin’s hash rate fell to a two-month low of 575 EH/s on May 10 as miners turned off unprofitable rigs after the halving.

- On May 9th, Bitcoin mining difficulty dropped by 6% to 83.15 T. Drops such as this have not been seen since 2022, when the bankruptcies of Terra and FTX caused disruption to the market.

- Bitcoin’s hash price reached a new all-time low of $44.5/PH/s on May 2, a 75% decrease from its post-halving peak of $180/PH/s.

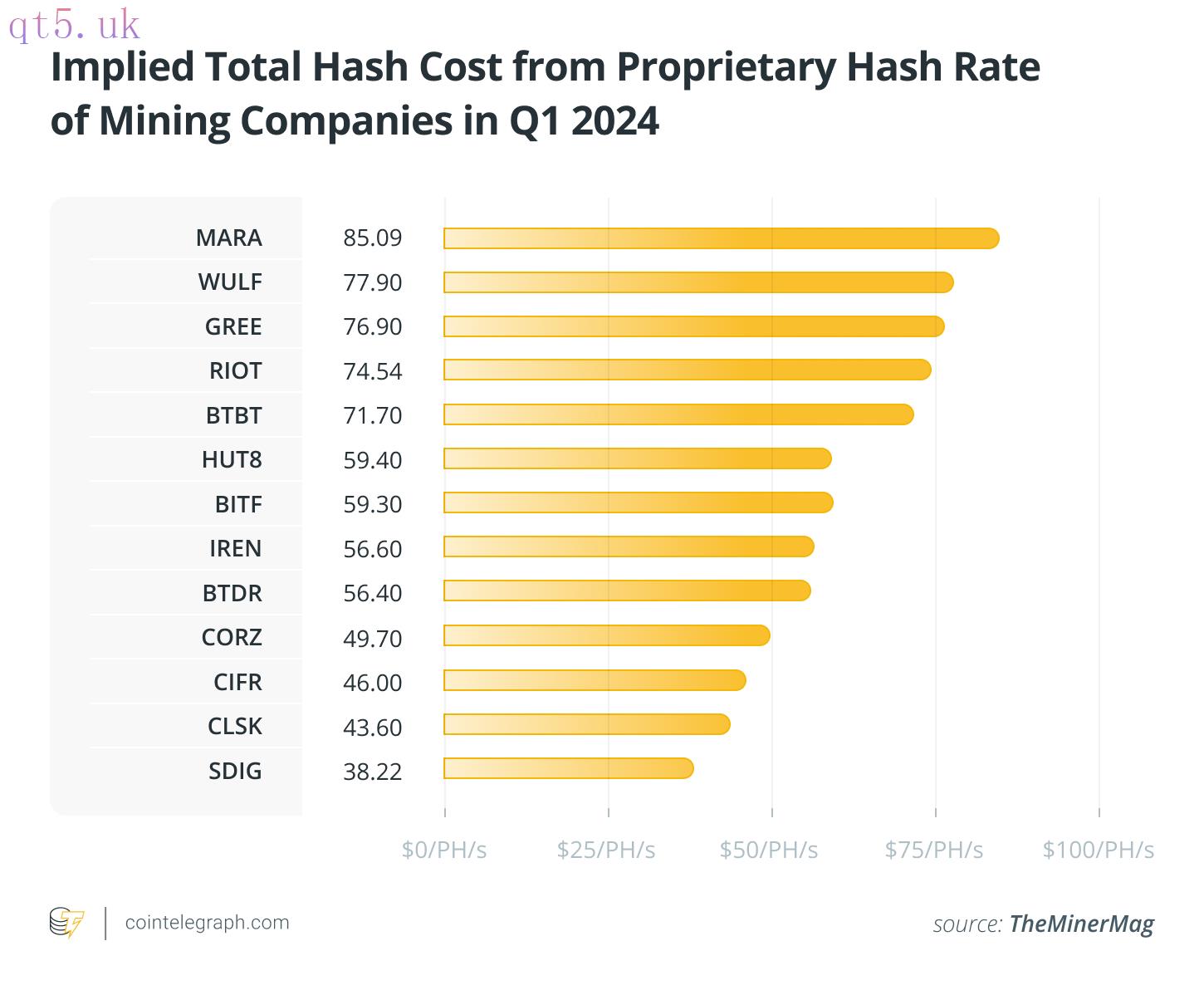

- According to TheMingMag, nine mining companies, including Marathon Digital Holdings, Riot Platforms, and TeraWulf Inc., had an estimated total hash cost of above $55/PH/s in Q1 2024. These costs are above the current hash price of $54/PH/s, which means that they operate below break-even.

Forecast

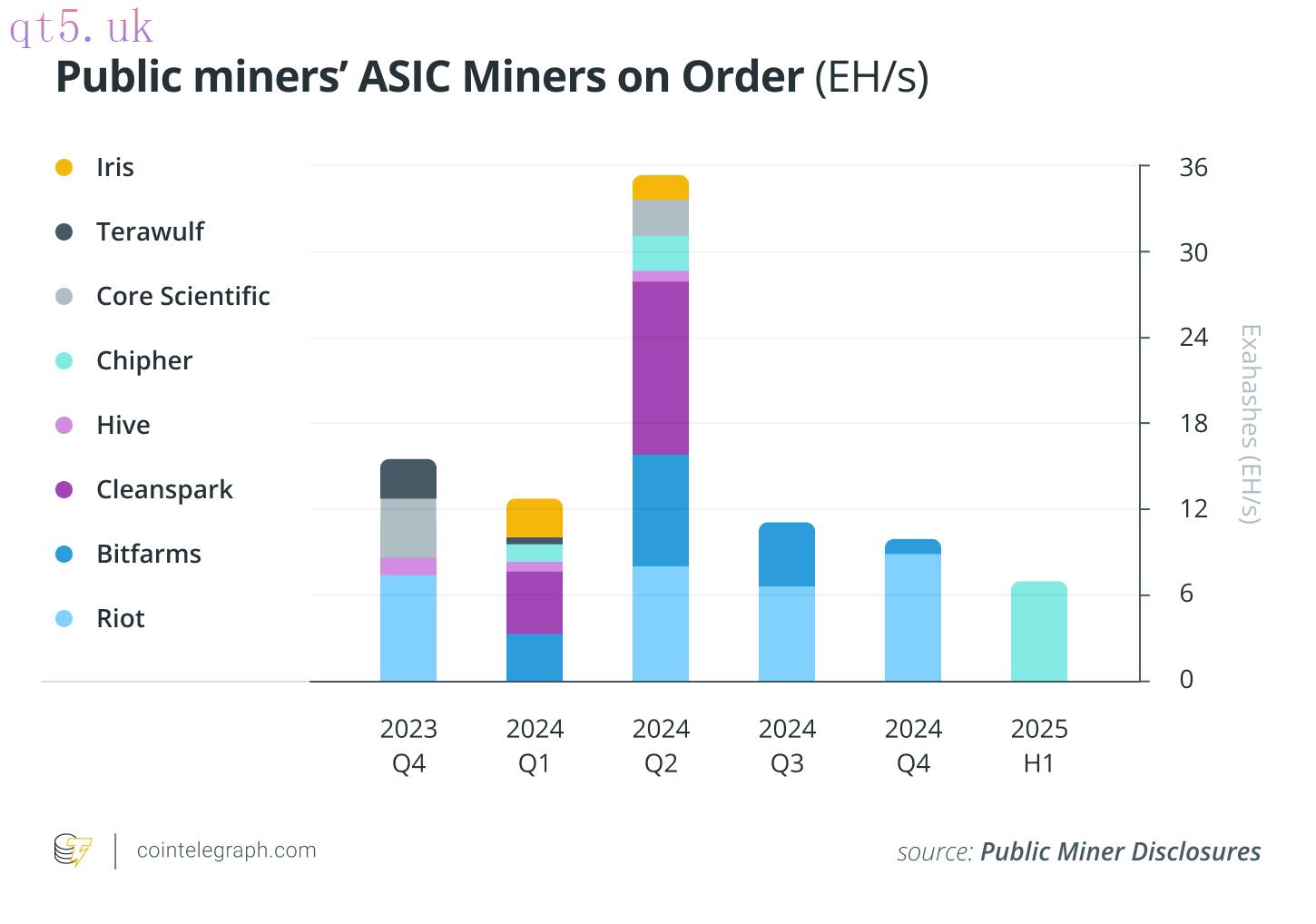

The current hash price is now close to the fleet hash cost for many mining companies. Based on compressed mining margins and declining investment in mining companies in Q1, hash rate may only grow slowly or enter a decline in the coming months. Miners in Texas also might have to reduce operations during the impending summer heat waves. However, mining farms ordered millions worth of next-generation rigs in 2023, such as the S21 and M50 series. Many of these orders will be delivered on a rolling basis throughout 2024 and will likely contribute to increases in hash rate at some point.

Sentiment

While some companies, such as Riot and Marathon, are thriving through efficient operations and strategic expansions, others struggle with profitability. This divergence underscores the pressure to optimize their operations by upgrading equipment, reducing energy costs, and seeking favorable regulatory environments.

Analysis

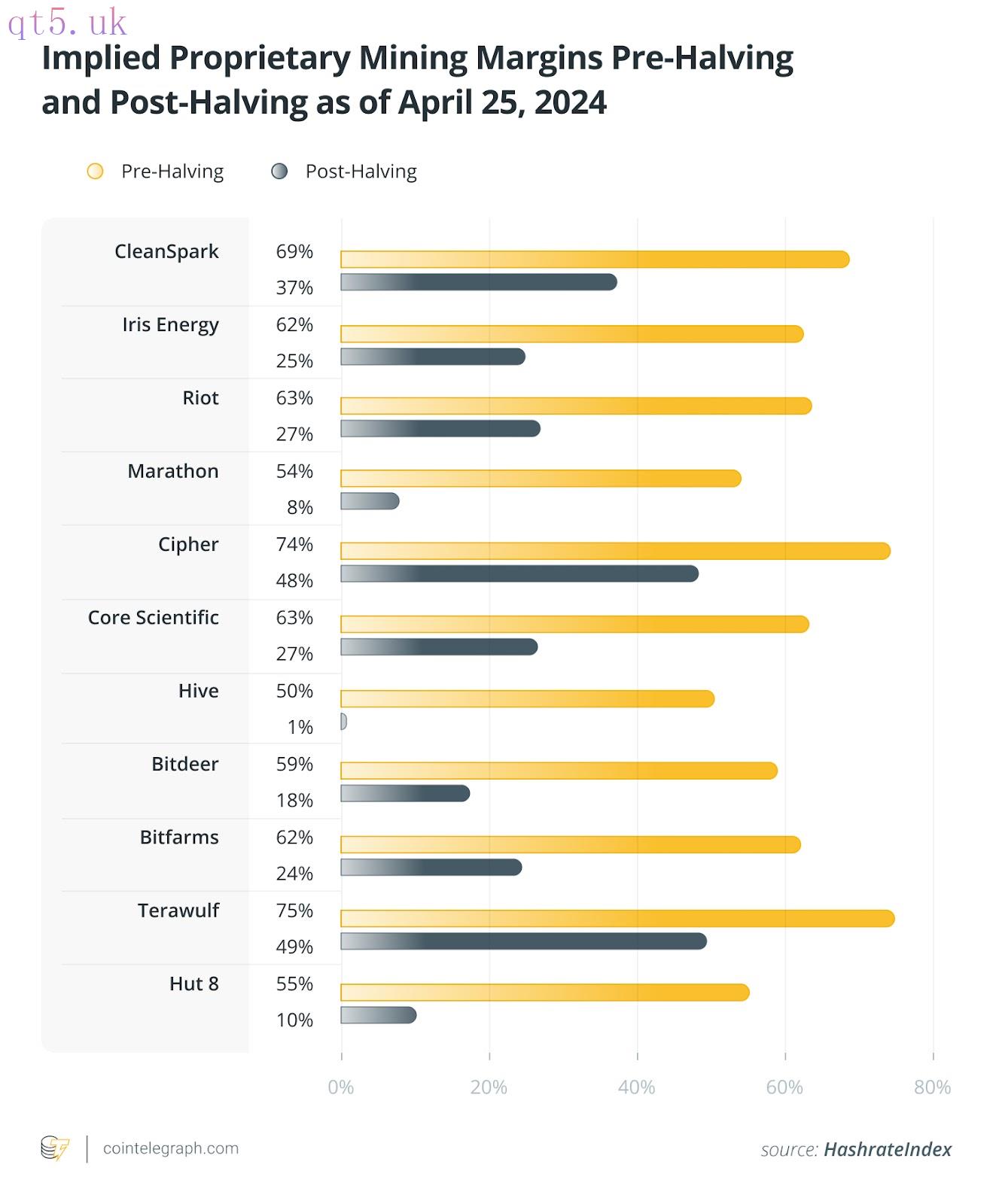

Despite a drop in the hash rate, miners’ margins remain compressed after the recent halving. Most companies saw margins decrease by over 50% between pre-halving levels and April 25.

Narrow margins have recently worsened as Bitcoin transaction fees came down from the fee spikes induced by Runes. Runes had contributed fees worth $117 million between April 19th and April 30th, 43% of all transaction fees in this period. After this source of revenue fell away, the hash price hit an all-time low of $44.43/PH/day on May 1. This caused a dent in the hash rate, whose 7-day moving average fell 11% from 580 EH/s. As a consequence, there was a negative difficulty adjustment of 6% on May 9, the largest since Dec. 5, 2022.

With current hash prices, mining companies are now struggling to cover operating costs. According to TheMinerMag, 9 out of 13 public mining companies had a total implied hash cost exceeding $55/PH/day in Q1 2024. These costs are above the current hash price of $54/PH/day, which means that they operate below break-even. These pressures are compounded by miners having to compete with AI data centers for power resources. Analysts at investment firm AllianceBernstein stated that this is already the case in places such as Texas.

Pressures on profitability are making the need to upgrade equipment more pressing. However, many mining companies are facing financial difficulties in expanding their fleets and upgrading to more efficient hardware as investment in the mining sector has declined. Public Bitcoin mining companies in North America raised nearly $2 billion in equity financing in Q1 2024, but less than $500 million has been invested so far in Q2. Mining companies mainly rely on equity financing to expand their operations. However, their stock performance has not been strong, which affects the funding amounts they can raise in the future. The launch of Bitcoin ETFs prompted some investors to rotate out of mining stocks and no longer consider them a proxy for exposure to Bitcoin. As of May 30, Marathon Digital (MARA) and Riot Platforms (RIOT), two of the largest U.S.-listed miners, have seen their stock prices drop by about 24% and 40%, respectively, even after Bitcoin climbed 60% year-to-date. Rising debt levels on the balance sheet of some companies also hinder further expansion. For example, Hut 8 Corp. recorded a debt-to-equity ratio of 29.52% in Q1 2024, approximately a 2x increase from 15% in Q1 2023. Similarly, TeraWulf Inc. has a high debt-to-equity ratio of 36.9%.

download

download download

download website

website