Bitcoin marked its third consecutive month of gains at the close of November, prompting a renewed interest in alternative cryptocurrencies (altcoins) that had initially picked up in October. Consequently, the total market value of all cryptocurrency projects, excluding Bitcoin (BTC) and Ether (ETH), has recently reached a peak last seen in August 2022.

The potential for an extensive “altseason” remains uncertain, but various industry sectors, previously inactive during the bear market, are beginning to exhibit early signs of revival. The Cointelegraph Research Monthly Trends report for December 2023 offers a comprehensive analysis of these emerging trends.

This month’s edition covers a range of topics, including Bitcoin market trends, developments in decentralized finance (DeFi), movements in crypto stocks, venture capital (VC) activities, derivatives, mining sector updates and the progress in tokenization of real-world assets.

Download a full version of the report for free here

Infrastructure and Web3 lead the charge in crypto VC funding flood

Amid persistent global geopolitical unrest and elevated interest rates in the European Union and the United States, the cryptocurrency VC sector experienced a surge in funding during November. Investment inflows reached $973 million through 93 separate deals, the most significant activity observed since June 2023, representing a nearly 40% increase from the previous month.

This contrasts sharply with October’s performance, where only three deals exceeded $20 million. In November, however, there were five investments, each surpassing the $50 million threshold. This surge in capital inflow may be driven by a combination of positive news sentiment, the recent uptrend in the cryptocurrency market and a temporary halt in interest rate hikes by the United States Federal Reserve.

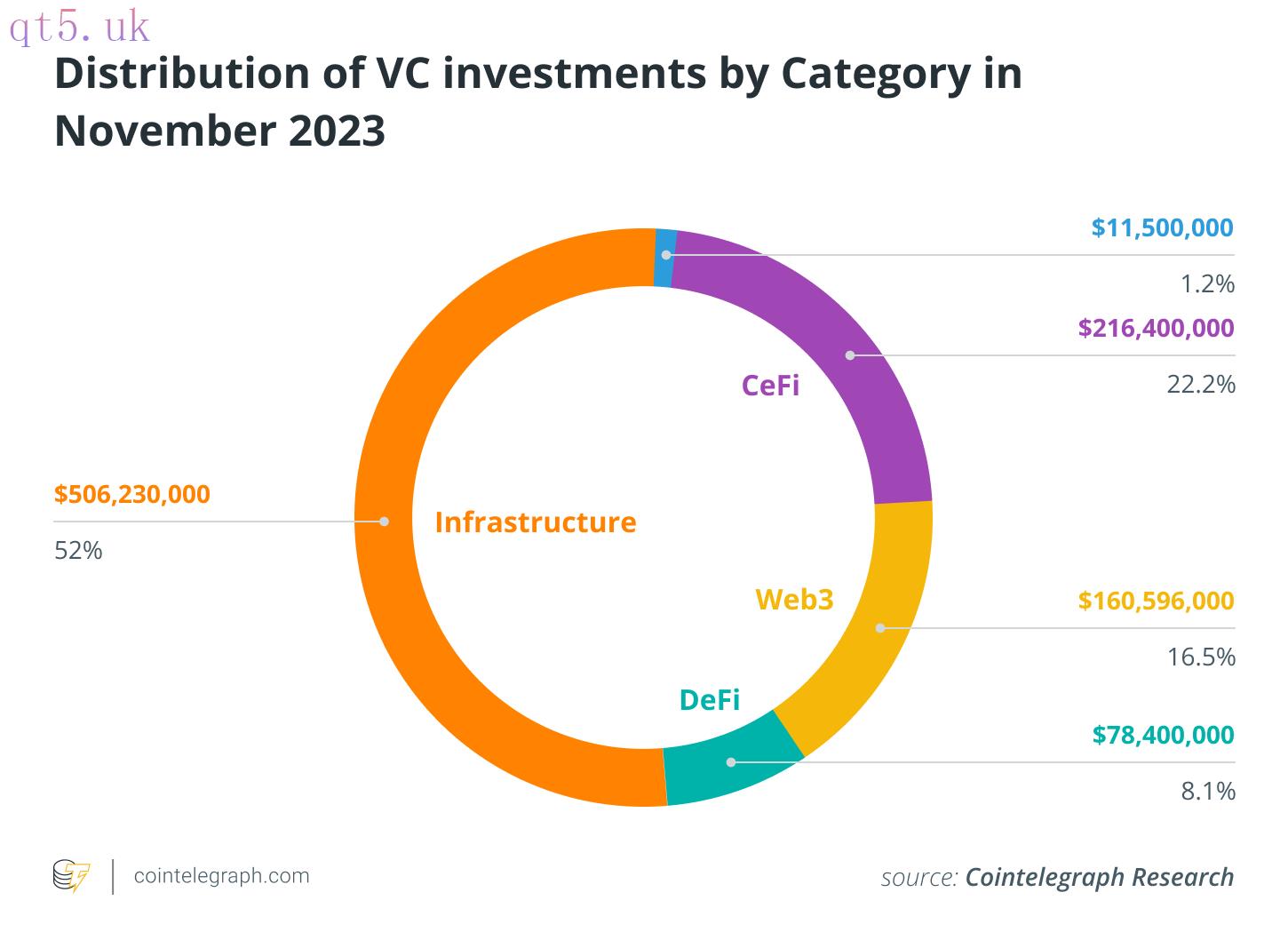

The infrastructure and Web3 sectors emerged as leaders in the number of funding rounds, recording 37 and 30 rounds, respectively. Centralized finance (CeFi) secured the second-highest investment volume this month, with $216.4 million distributed across five deals.

This unexpected surge can be largely attributed to two substantial funding events: Blockchain.com secured $110 million in a Series E funding round, and OSL, a centralized exchange operated by BC Technology Group in Hong Kong, completed a $90 million round. Following closely, the Web3 and DeFi sectors raised $160.5 million and $78.4 million, respectively.

Meanwhile, the nonfungible token (NFT) sector concluded the list with a relatively modest three funding rounds, amassing $11.5 million.

Bitcoin futures surge in popularity on the CME

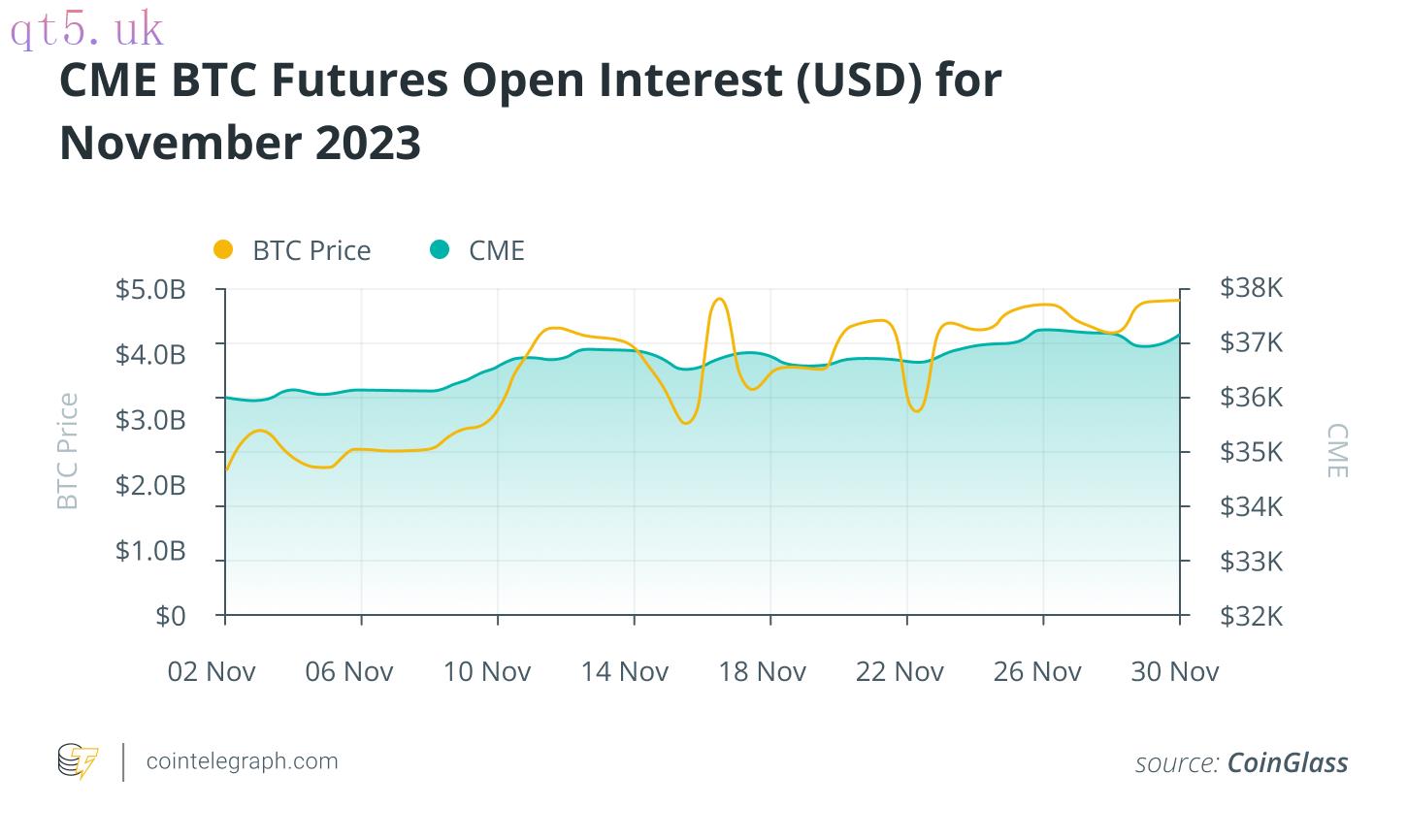

Venture capital activities and modest rallies in minor altcoins indicate a shift of capital toward higher-risk assets. This trend is anticipated to intensify following the potential approval of a spot Bitcoin exchange-traded fund (ETF) in the United States. Leading ETF analysts James Seyffart and Eric Baluchnas recently increased their likelihood estimates for an approval by Jan. 10 to 90%.

This optimism is mirrored in the rising institutional interest in Bitcoin-based exchange-traded products. Evidence of this growing interest can be seen in the Bitcoin futures market on the Chicago Mercantile Exchange (CME), where open interest escalated by more than 20% in November.

Cointelegraph Research team

Cointelegraph’s Research department comprises some of the best talents in the blockchain industry. Bringing together academic rigor and filtered through practical, hard-won experience, the researchers on the team are committed to providing the most accurate, insightful content available on the market.

With decades of combined experience in traditional finance, business, engineering, technology, and research, the Cointelegraph Research team is perfectly positioned to put its combined talents to proper use with the latest Investor Insights Report.

Download a full version of the report for free here

Additional report by Ilya Lazarev and Nick M.

The opinions expressed in this article are for general informational purposes only. They are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Cointelegraph does not endorse the content of this article nor any product mentioned herein. Readers should do their own research before taking any action related to any product or company mentioned and carry full responsibility for their decisions.

download

download download

download website

website