Highlights:

- Paradigm is leading a $225 million funding round for a new layer-1 blockchain network by Monad Labs. The project aims to compete for market share with Solana and other top networks.

- Web3-native investment company Borderless Capital acquired CFT Capital. The move adds artificial intelligence and proprietary quant trading products to Borderless’ businesses.

- Decentralized exchange MerlinSwap raised 6,599 BTC, worth $480 million, during its initial DEX offering from over 52,000 investors, setting a record for IDOs.

Forecast

The current market dynamics, and recent announcements of fund launches by notable VCs indicate a positive outlook for the cryptocurrency VC sector. Areas of interest include emerging technologies and infrastructure improvements, such as DePINs, BTCFi, AI, and scaling technologies. We project that these areas will experience the most significant funding and growth.

Sentiment

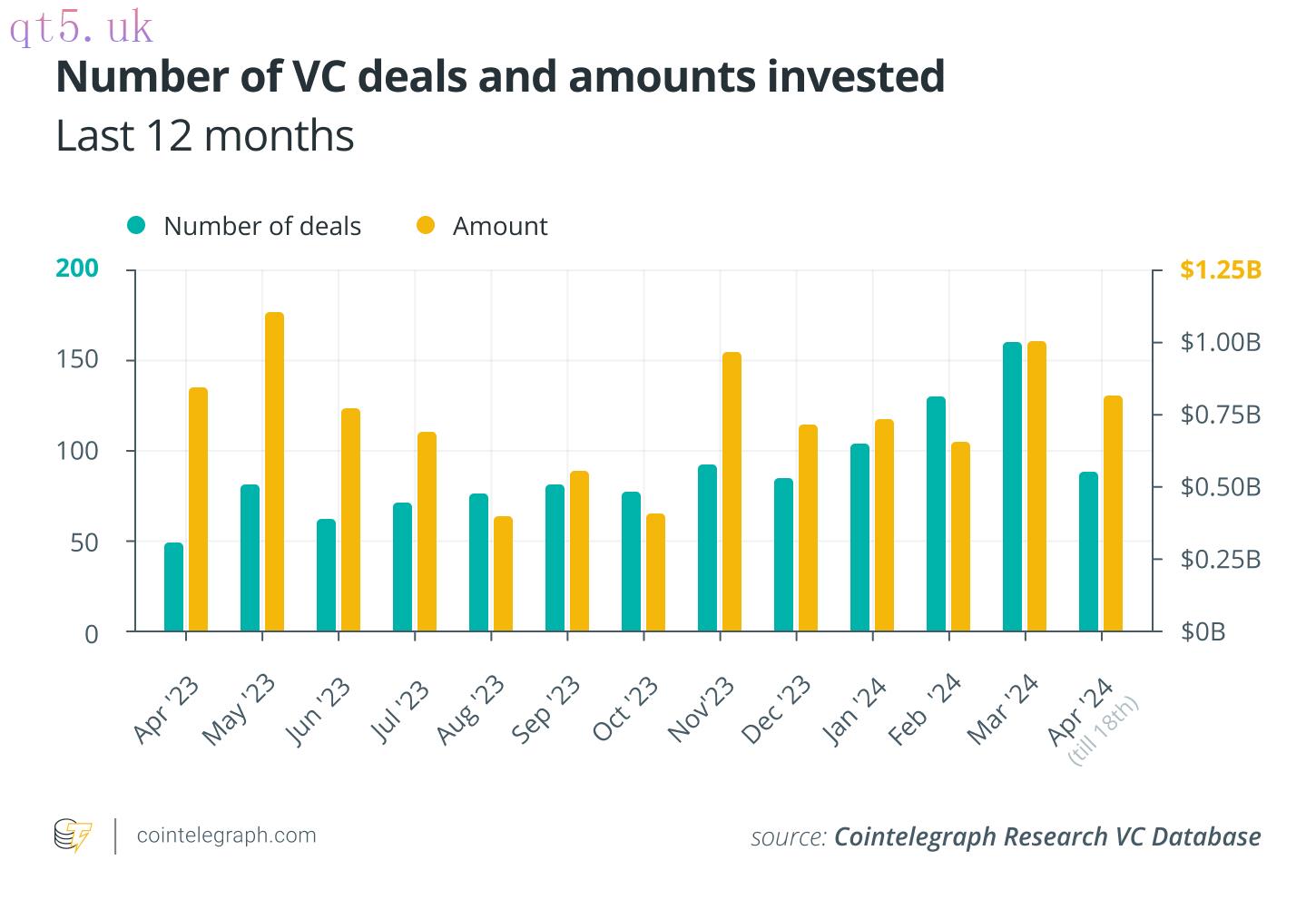

The cryptocurrency venture capital market is experiencing a significant uptick, with the highest number of deals in a 12-month period by March. This surge has occurred despite a cooling-off period for Bitcoin and other major cryptocurrencies. The fresh influx of venture capital is also invigorating developer activity. This is particularly evident in emerging sectors such as artificial intelligence, L1s/L2s/L3s and other infrastructure solutions.

Analysis

The venture capital market has continued to revitalize in March and April of 2024. March concluded with 161 individual deals, setting a 12-month record. Total investments exceeded $1 billion and grew by 52% from the previous month. Although April has not yet concluded, it has already recorded 90 deals, attracting over $820 million in investments.

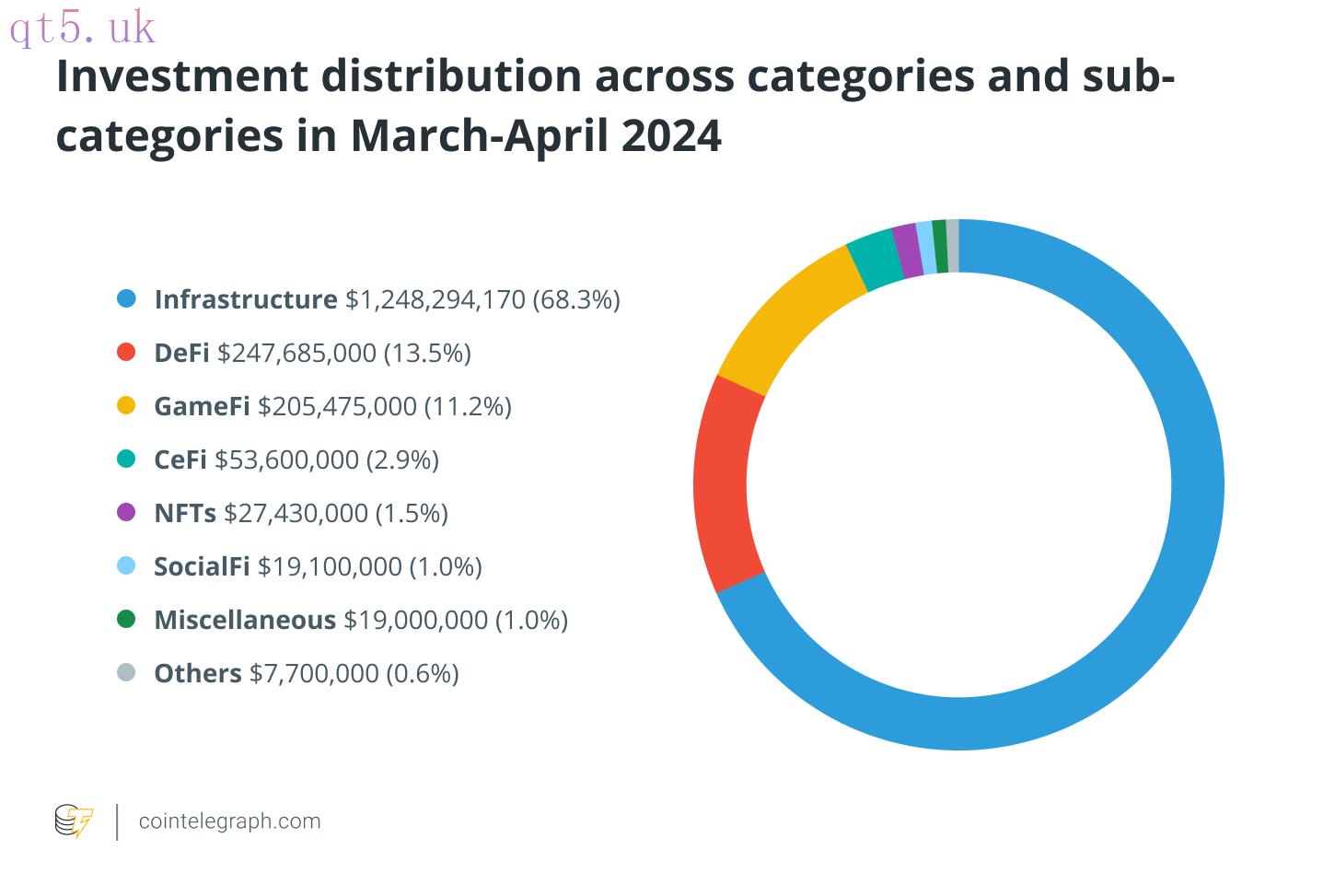

Currently, the infrastructure sector is proving to be the most attractive to investors, garnering more than $1.2 billion in March and April combined.

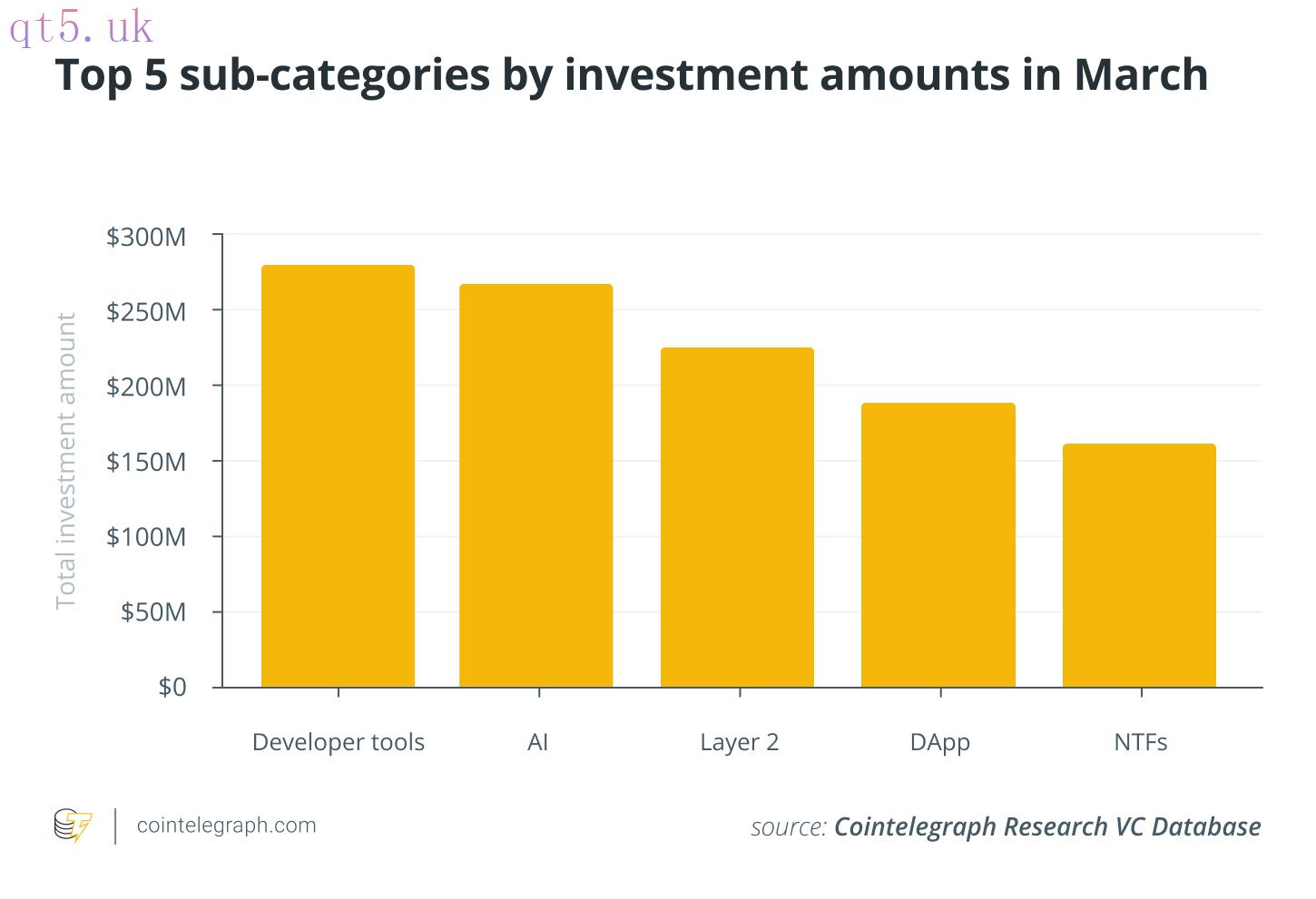

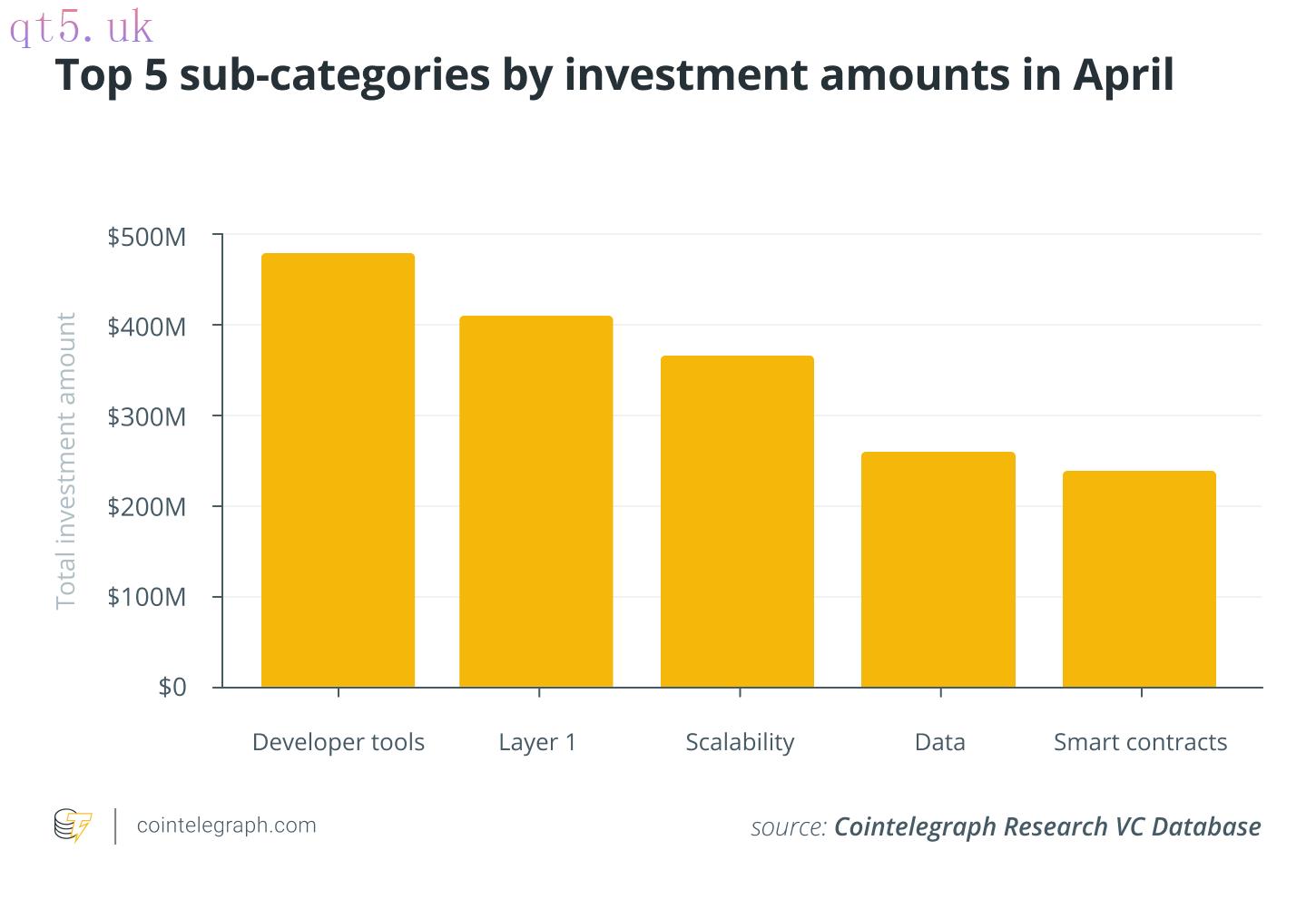

The chart for the top-5 sub-categories indicates a strong investor focus on emerging technology and infrastructure solutions, including Developer Tools, AI solutions, and L1s/L2s.

The resurgence of the crypto VC market is bolstered by several funds that have been announced or launched in recent months. Apart from Hack VCs and Immutable x Polygon Funds, which were covered in the previous edition, there have been several new fund announcements since then. The most notable one is Paradigm, which seeks capital to re-enter the crypto VC landscape with a $850 million fundraising announcement. If Paradigm manages to launch its fund, it will become the biggest launch since May 2022. Galaxy Digital is also raising money and announced a $100 million fund with a primary focus on early-stage ventures. 1kx raised another $75 million from Marc Andreessen, Galaxy Digital and Accolade, to launch a fund aimed at infrastructure solutions, particularly crypto-based consumer applications. While some venture capitalists have not yet disclosed the specific objectives of their newly announced funds, key areas of interest currently include AI, BTCFi, DePINs and scaling solutions.

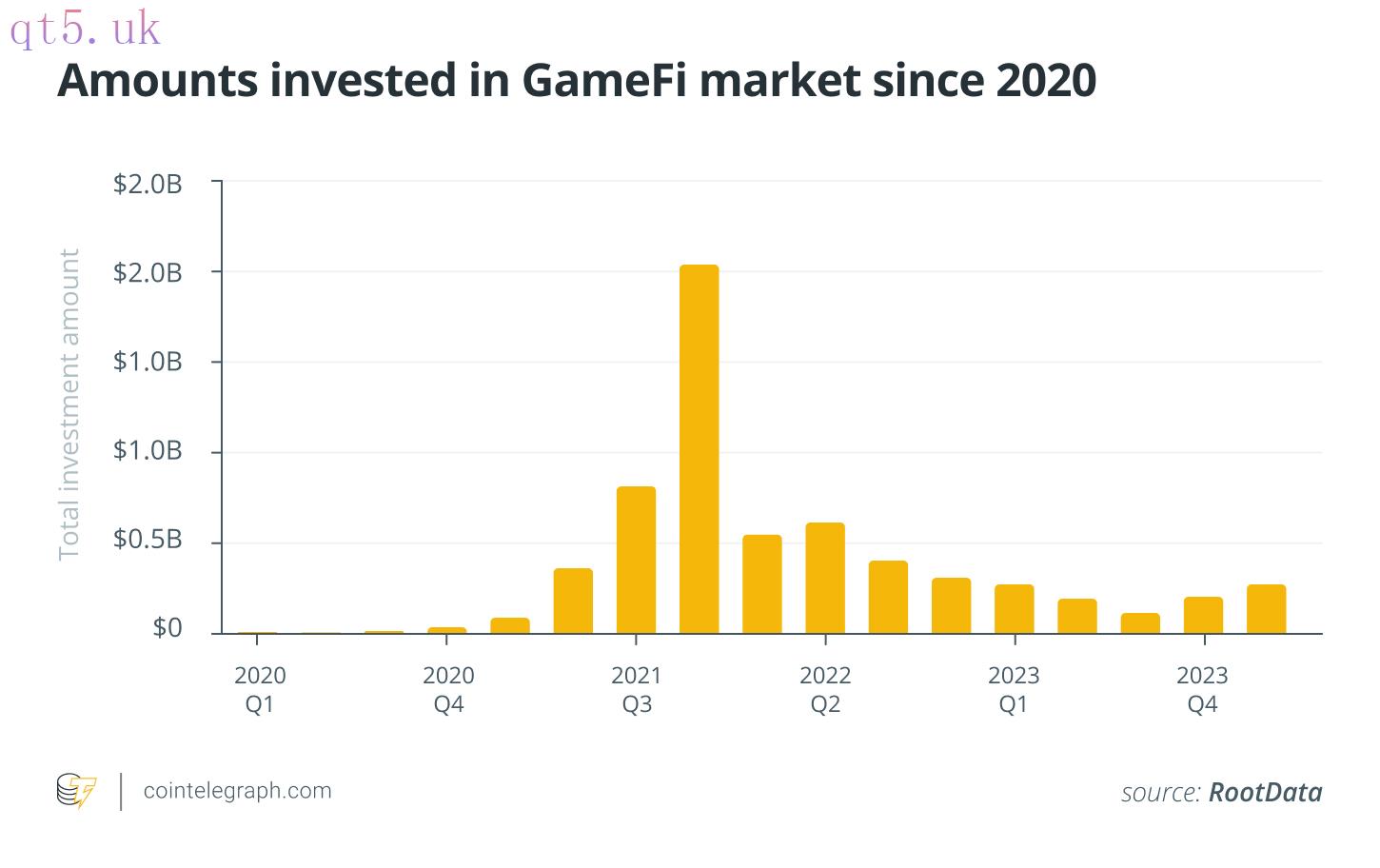

The GameFi sector also shows signs of revival. After reversing a downward investment trend in Q3 2023, the sector has continued to grow in 2024. Investors are now increasingly favoring novel technologies and proven business models over narrative-driven FOMO. The GameFi sector’s performance is supported by a16z, which plans to inject $30 million into technology-driven gaming startups, focusing on those that use AI, VR/AR, and Web3 technology. The capital will be deployed through the firm’s early-stage accelerator program “SPEEDRUN,” with a $750,000 investment allocation to each startup that joins.

download

download download

download website

website