Bitcoin (BTC) fell below $60,000 during the week, but lower levels attracted buyers who are trying to start a recovery. Bitcoin remains stuck inside the $56,552 to $73,777 range, indicating a tussle between the bulls and the bears. It is difficult to predict the direction of the breakout with certainty. Hence, traders may either trade the range or wait for the breakout to happen before establishing large bets.

Investors are divided about Bitcoin’s future price action. Former PayPal CEO Peter Thiel believes that Bitcoin does not have much room to run on the upside. While speaking to CNBC, Thiel said that Bitcoin’s price may rise a little, “but it’s going to be a volatile, bumpy ride.”

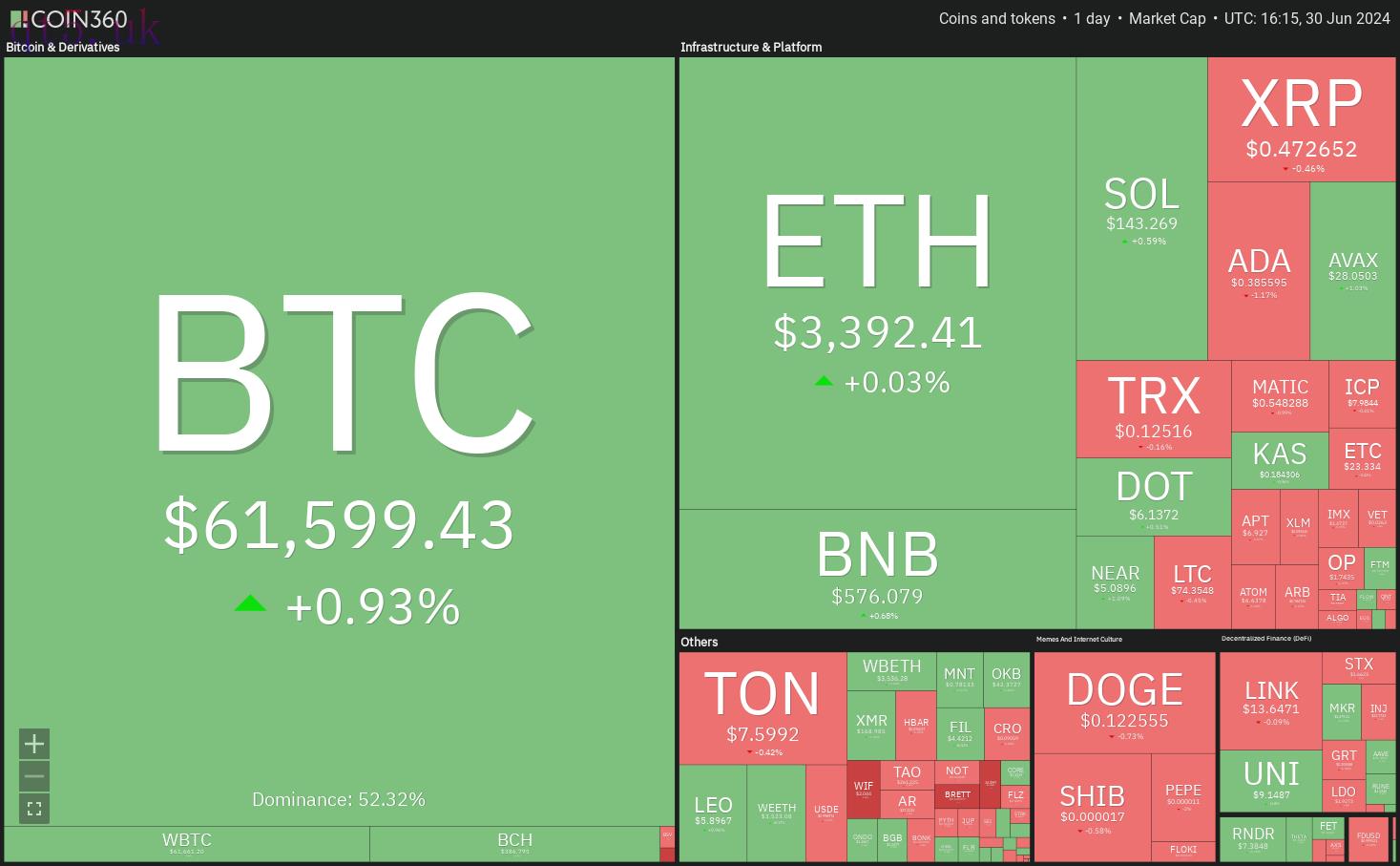

Crypto market data daily view. Source: Coin360

Crypto market data daily view. Source: Coin360In contrast, popular trader BitQuant is bullish on Bitcoin. He said in a post on X that his Bitcoin model points to a target objective of $95,000 every time he runs it.

Bitcoin’s drop toward $60,000 has increased selling in several altcoins, but a few have bucked the trend. Let’s study the top 5 cryptocurrencies that look strong on the charts.

Bitcoin price analysis

Bitcoin bulls have managed to defend the $60,000 level in the past few days but are struggling to push the price above $62,500.

BTC/USDT daily chart. Source: TradingView

BTC/USDT daily chart. Source: TradingViewThe downsloping 20-day exponential moving average ($63,651) and the relative strength index (RSI) in the negative territory suggest that the bears hold the edge. If the $60,000 support breaks down, the BTC/USDT pair could plummet to $56,552. Buyers are expected to defend this level with all their might because failing to do so may sink the pair to $50,000.

Contrarily, if the price turns up and breaks above $62,500, it will suggest that the bulls are attempting a comeback. The pair could then rise to the crucial resistance at $64,602 and subsequently to $70,000.

BTC/USDT 4-hour chart. Source: TradingView

BTC/USDT 4-hour chart. Source: TradingViewThe 20-EMA on the 4-hour chart is flattening out, and the RSI is just above the midpoint, indicating a balance between supply and demand. If the price rises above $62,500, it will suggest the start of a strong recovery. The pair could attempt a rally to $64,602.

The first sign of weakness will be a break and close below the 20-EMA. That could open the doors for a fall to critical support at $60,000. If this level is taken out, the pair may plunge to $58,402.

Toncoin price analysis

Toncoin (TON) is struggling to sustain above $7.67, but a positive sign is that the bulls have not allowed the price to skid below the 20-day EMA ($7.43).

TON/USDT daily chart. Source: TradingView

TON/USDT daily chart. Source: TradingViewThe upsloping moving averages and the RSI in the positive territory indicate that the path of least resistance is to the upside. If bulls drive the TON/USDT pair above $7.67, the rally could retest the critical resistance of $8.29. If this level is scaled, the pair may attempt a move to $10.

This positive view will be invalidated in the near term if the price turns down sharply and breaks below $6.60. That will complete a bearish head-and-shoulders pattern, which has a target objective of $4.91.

TON/USDT 4-hour chart. Source: TradingView

TON/USDT 4-hour chart. Source: TradingViewThe 4-hour chart shows that the bulls are buying the dips to the 50-SMA. If the price rises and sustains above $7.67, the pair may start its journey to $8.29. However, the bears are unlikely to give up easily and will pose a strong challenge at $7.87 and again at $8.1.

The first sign of weakness will be a break and close below the 50-SMA, indicating selling by the short-term traders. The pair may slump to $7 and later to $6.77. Buyers are expected to aggressively defend the zone between $6.66 and $6.77.

Avalanche price analysis

Buyers are trying to propel Avalanche (AVAX) above the $29 overhead resistance to start a strong recovery.

AVAX/USDT daily chart. Source: TradingView

AVAX/USDT daily chart. Source: TradingViewThe up move is facing resistance at $29, but a positive sign is that the buyers have not ceded ground to the bears. This suggests that the bulls are maintaining their buying pressure, increasing the likelihood of a break above the resistance. If that happens, the AVAX/USDT pair could rise to the 50-day SMA ($32.78).

On the contrary, if the price turns down sharply from the current level, it will signal that the bears have flipped the $29 level into resistance. The pair could then retest the June 24 intraday low of $23.51.

AVAX/USDT 4-hour chart. Source: TradingView

AVAX/USDT 4-hour chart. Source: TradingViewThe 4-hour chart shows that the pair is trying to form an inverse H&S pattern that will complete on a break and close above $29. The pair could then start a rally to the pattern target of $34.50.

Contrary to this assumption, if the price continues lower and breaks below the 20-EMA, it will suggest profit booking by short-term traders. The pair may then tumble to the 50-SMA and eventually to $23.51.

Related: Nigeria urged to adopt crypto regulations inspired by Europe

Kaspa price analysis

Kaspa (KAS) surged and closed above the overhead resistance of $0.19 on June 29, completing a cup-and-handle pattern.

KAS/USDT daily chart. Source: TradingView

KAS/USDT daily chart. Source: TradingViewThe upsloping moving averages and the RSI in the overbought territory suggest that the bulls are in control. If buyers maintain the price above $0.19, the KAS/USDT pair could start the next leg of the rally. The pair may climb to $0.24 and reach the pattern target of $0.28.

Alternatively, if the price turns down sharply from the current level and breaks below $0.19, it will suggest that the recent breakout may have been a bull trap. That may pull the price down to the 20-day EMA ($0.16).

KAS/USDT 4-hour chart. Source: TradingView

KAS/USDT 4-hour chart. Source: TradingViewThe 4-hour chart shows that the bears tried to trap the aggressive bulls by pulling the price below $0.19, but the buyers held their ground. The bulls will try to build upon their advantage and drive the price to $0.22 and then to $0.24.

Time is running out for the bears. If they want to make a comeback, they will have to quickly yank the price below the breakout level of $0.19 and then the 20-EMA. That may start a long liquidation, pulling the pair to the 50-SMA.

Monero price analysis

Monero (XMR) is attempting to bounce off the 20-day EMA ($165), indicating that the sentiment is turning bullish and traders are buying on dips.

XMR/USDT daily chart. Source: TradingView

XMR/USDT daily chart. Source: TradingViewThe flattish 20-day EMA and the RSI just above the midpoint suggest that the bears are losing their grip. If the price rises above $172, the XMR/USDT pair could rally to the stiff resistance at $180 and thereafter to $190.

On the other hand, if the price turns down from the current level and breaks below the 20-day EMA, it will suggest that the bears have not given up. That could sink the pair to the 50-day SMA ($155). A break and close below the 50-day SMA will tilt the advantage in favor of the bears.

XMR/USDT 4-hour chart. Source: TradingView

XMR/USDT 4-hour chart. Source: TradingViewThe moving averages have completed a bullish crossover, and the RSI is in the positive territory on the 4-hour chart, indicating that the bulls have the edge. There is a minor resistance at $172, but it is likely to be crossed. The pair could then march higher toward $180.

This optimistic view will be negated in the near term if the price turns down and breaks below the 50-SMA. The bears will then try to tug the price below the $160 to $156 support zone.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

download

download download

download website

website