Bitcoin (BTC) experienced a modest increase in the past 24 hours, climbing approximately 1.5% to as high as $61,700 as of June 28. This upward movement accompanies broader gains across the cryptocurrency market, spurred by the resumption of inflows into Bitcoin exchange-traded funds (ETF) and VanEck's Solana ETF application.

BTC/USD four-hour price chart. Source: TradingView

BTC/USD four-hour price chart. Source: TradingViewU.S. investors return to Bitcoin ETFs

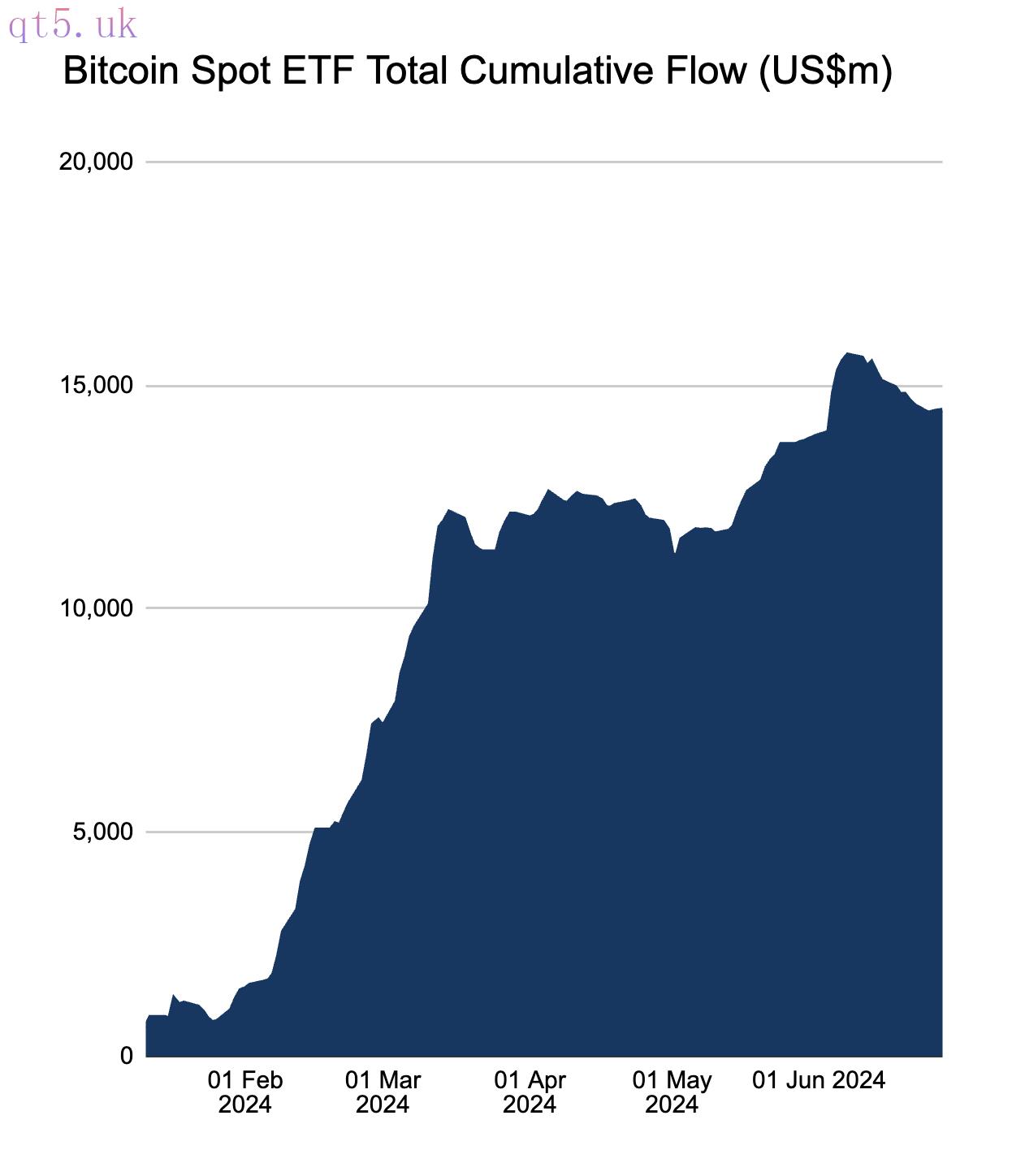

Today’s Bitcoin gains followed three consecutive days of inflows into U.S.-based Bitcoin ETFs, indicating a resurgence of risk appetite following a week-long streak of outflows.

As of June 27, these Bitcoin ETFs had $14.44 billion worth of assets under management, bouncing from the low of $14.383 billion established three days ago. However, at their peak on June 6, these funds were holding $15.68 billion.

Spot Bitcoin ETFs cumulative inflows. Source: Farside Investors

Spot Bitcoin ETFs cumulative inflows. Source: Farside InvestorsBitcoin and the rest of the crypto market picked further upside cues from VanEck after it filed for a new spot Solana ETF in the United States. The Wall Street firm now has two pending crypto ETF applications with the U.S. Securities and Exchange Commission (SEC), the other being for Ethereum.

Bitcoin rises ahead of PCE data

Today’s Bitcoin gains mirrored similar upside moves in U.S. stock futures as investors awaited the May reading of the Personal Consumption Expenditures, or PCE, price index.

A Bloomberg survey of economists revealed that most expect the Fed’s preferred inflation gauge to have declined to an annualized rate of 2.6% last month, down from 2.8%. This would mark the lowest reading since March 2021, although it still exceeds the central bank’s 2% inflation target.

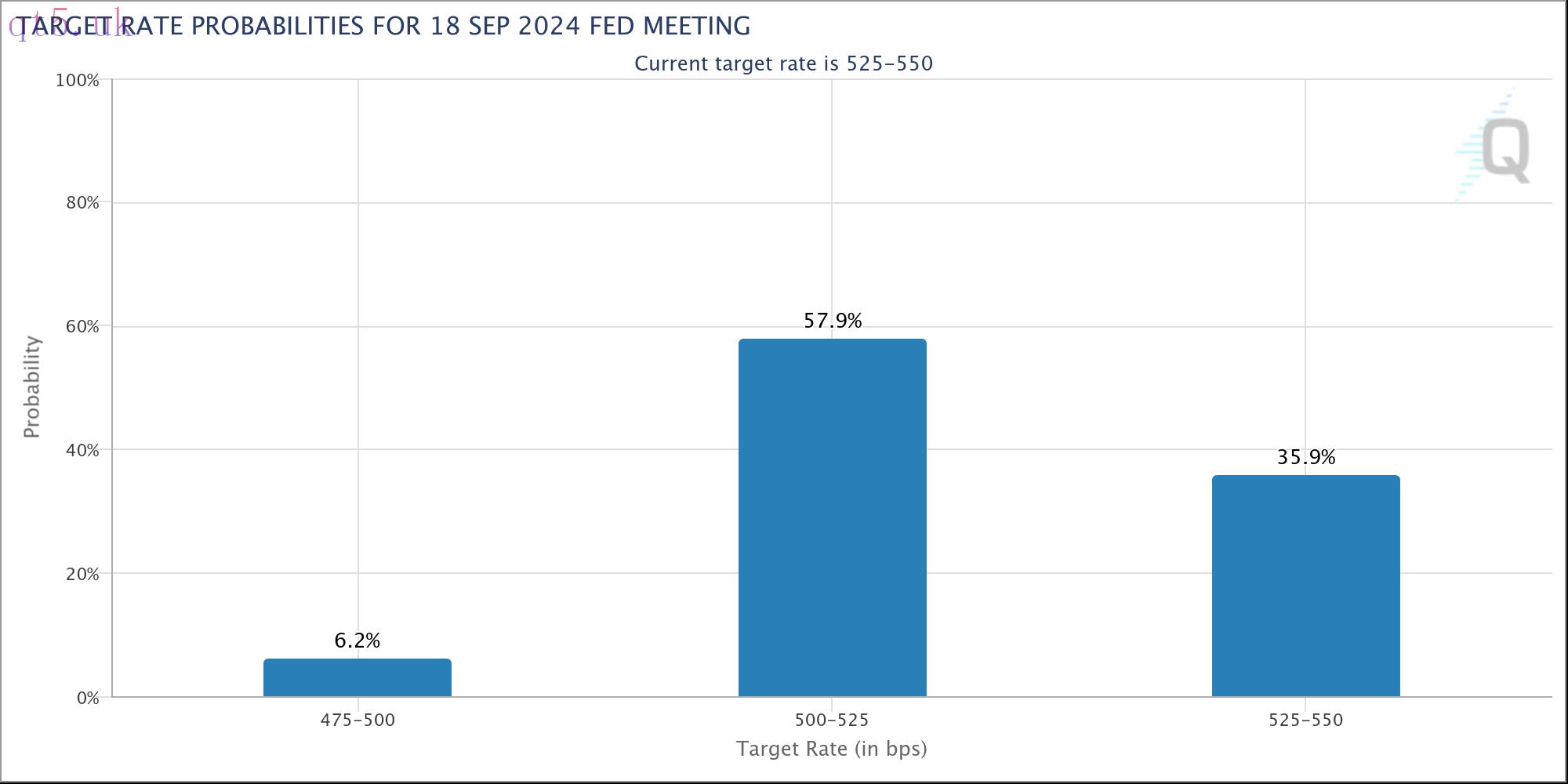

A slowdown in inflation may enable the Fed to cut interest rates in 2024. Bond traders already see a 57.9% probability of the Fed slashing the benchmark lending rates by 25 basis points in September, compared to 41.7% a month ago.

Target rate for Fed's Sep. 18 Fed meeting. Source: CME

Target rate for Fed's Sep. 18 Fed meeting. Source: CMELower interest rates reduce the opportunity costs of holding safe-havens like the U.S. bonds. In turn, they typically boost investors' appetite for riskier assets like crypto and stocks, which is helping Bitcoin rally today.

Bitcoin bounce is part of consolidation trend

Today, Bitcoin's rally is part of price fluctuations inside its prevailing consolidation trend. Interestingly, this pattern appears to be forming a pennant, which increases the potential of a bearish continuation ahead in the context of BTC's previous downside move.

BTC/USD four-hour price chart. Source: TradingView

BTC/USD four-hour price chart. Source: TradingViewA bear pennant resolves when the price breaks below its lower trendline and falls by as much as the height of its previous downtrend. Applying the same technical rule on Bitcoin's ongoing price trends bring its July downside target to $56,250, down about 8.5% from the current price levels.

Related: Bitcoin miner sell pressure ‘weakening’ as BTC withdrawals drop 85%

Bitcoin’s potential to undergo a breakdown increases further due to two strong resistance levels: the 50-4H exponential moving average (50-4H EMA; the red wave) and the descending trendline. Both are aligning with the pennant's upper trendline at around $62,000.

However, a decisive break above this group of resistances could invalidate the bear pennant altogether, setting BTC's price toward the 200-4H EMA (the blue wave) at around $65,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

download

download download

download website

website