Silver approaches key support level - watch for potential rebound signals

Silver approaches key support zone – what to watch for potential rebound signs

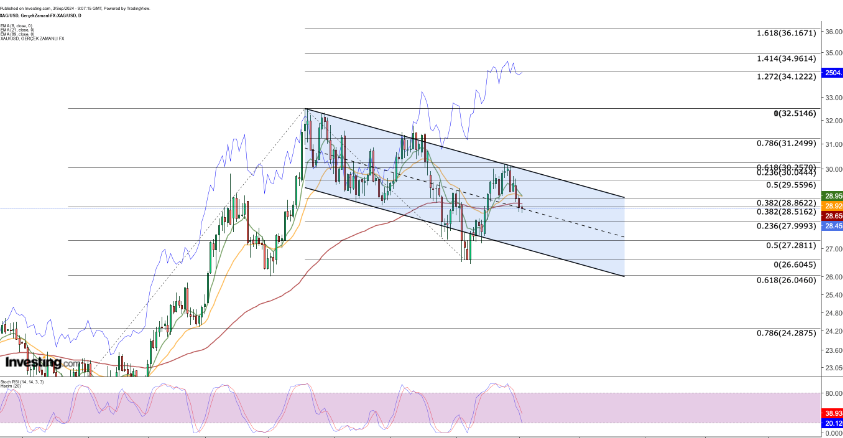

Silver prices are currently testing the key support level of $28.5, which is also the middle line of its downward channel and the 0.382 Fibonacci retracement level of the upward trend. The holding of this level will be key in determining the short-term trend of silver.

From a technical perspective, silver faces some selling pressure in the short term. Its short-term moving averages have turned downward and the price has also fallen below the 3-month moving average, indicating a bearish outlook. In addition, the stochastic RSI has reversed sharply near $30, which also highlights the intensity of selling pressure.

However, if silver prices can find support at $28.5, investors may view the recent decline as a buying opportunity, hoping to reverse the trend. In this case, the $29.6-30 range may be tested again. If this range is broken, it may mark the end of the correction phase.

From a broader economic perspective, if central banks in developed economies start to cut interest rates and US dollar yields fall, this may increase demand for silver, a non-yielding asset. If the U.S. economy avoids recession and continues to grow, increased industrial demand for silver may also push up its price.

Overall, the $28.5 level is still the key to determining the short-term trend of silver. Investors need to pay close attention to the performance of this support level to understand the potential rebound opportunities of silver in the future.

- AI-CrypTo platform provides you with the safest, most stable and most profitable cryptocurrency automatic quantitative trading system! With a minimum deposit of 10 USDT, you can activate your investment account and enjoy stable returns and flexible withdrawals! 💵

- Each model has a different rate of return, choose a higher level of investment to earn more! AI quantitative returns range from VIP1 to VIP11, with daily returns as high as 40.9%! The more you invest, the greater the return! 💸

download

download download

download website

website