Why Bitcoin price has nothing to do with the Fed’s rate cut? Ex-BitMEX head explains

Arthur Hayes Explains Why Fed Rate Cuts Won’t Help Bitcoin

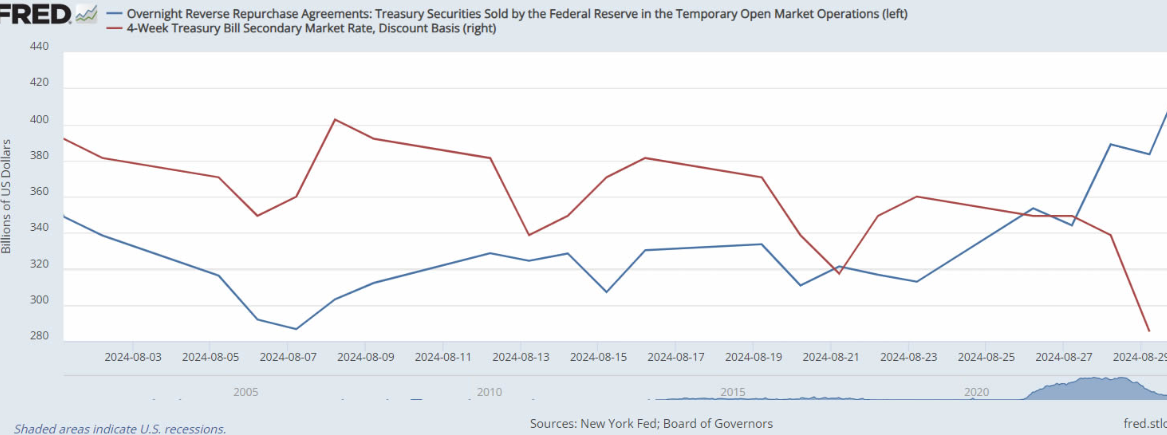

According to Arthur Hayes, former chief executive of BitMEX, funds are moving from Treasuries to repurchase agreements, which offer higher returns.

BitMEX co-founder and former CEO Arthur Hayes shared his views on why the Fed’s rate cuts may not have much impact on Bitcoin prices.

In a Sept. 2 article, the Maelstrom chief investment officer noted that despite Fed Chairman Jerome Powell all but confirming a September rate cut in his Jackson Hole speech on Aug. 23, Bitcoin prices have struggled and fallen since then.

Since the speech, BTC prices surged as high as $64,000 before falling 10% to a low of $57,400 on Sept. 2. As of the time of writing on Sept. 3, BTC prices have recovered slightly to $59,238.

Hayes explained that the reason is that large money market funds are moving cash from Treasury bonds to repurchase agreements (RRPs), which have a yield of 5.3%, higher than the 4.38% of Treasury bonds.

He pointed out that this development goes against the assumption that low interest rates are good for risky assets such as Bitcoin. Many believe that low interest rates encourage borrowing and spending, thereby increasing market liquidity, and a weaker dollar may make Bitcoin look stronger.

According to the Chicago Mercantile Exchange, there is a 69% probability that the Federal Reserve will cut interest rates by 25 basis points at its September 18 meeting, and a 31% probability of a 50 basis point cut. A larger rate cut would indicate a more aggressive stance by the Federal Reserve, which could trigger a more drastic market reaction and thus boost economic activity to a greater extent.

- AI-CrypTo platform provides you with the safest, most stable and most profitable cryptocurrency automatic quantitative trading system! With a minimum deposit of 10 USDT, you can activate your investment account and enjoy stable returns and flexible withdrawals! 💵

- Each model has a different rate of return, choose a higher level of investment to earn more! AI quantitative returns range from VIP1 to VIP11, with daily returns as high as 40.9%! The more you invest, the greater the return! 💸

download

download download

download website

website